“A magician creates magic and mesmerizes the audience. But it is a pantomime, and the audience knows that it’s a ruse. It’s in the name: a “magic trick”. They play along when the magician tugs his sleeves to show there is nothing hidden within them, or that the top hat is empty of a rabbit, or eggs, or flowers. Beneath the façade there is only sleight of hand, wires and contraptions, misdirection at a key moment.” – Laura Lam, Shadowplay

–

18 years back Amazon went public with an IPO of $ 40 million. Till the IPO, Amazon had raised less than $ 10 million (a number that is a rounding error when compared to the fund raises of e-tailers in India). Since the IPO, Amazon has not raised any external equity capital and is today valued at more than $ 200 billion. Amazon’s valuation is widely debated by analysts on the long and short side. Analysts with a bearish view largely point to the negligible profits and the slowing growth of Amazon. Analysts with a bullish view rubbish this dogmatic approach to valuing a company. They point to Amazon’s dominant position in North American e-retail and more importantly to its robust cash flows.

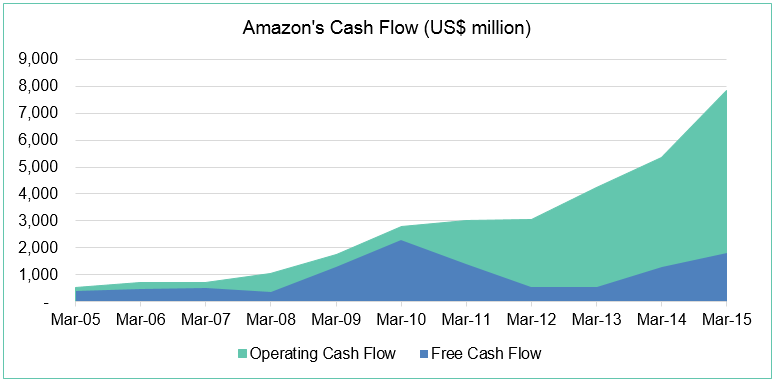

Amazon’s cash flows have indeed been spectacularly good allowing it to grow to more than $ 90 billion in annual revenues despite its low profitability. Several analysts argue that cash flows are what really matters for valuing Amazon. As the saying goes, profit is an opinion but cash is a fact. Benedict Evans, ace investor and Partner at Andreesen Horowitz, has made a strong argument to look at Amazon from a cash flow perspective (Why Amazon Has No Profits (And Why It Works). Justin Fox made a similar argument on the Harvard Business Review ((At Amazon, It’s All About Cash Flow). Amazon and Jeff Bezos have also time and again cited their preference for free cash flow (FCF) over profits.

There is little to disagree with an approach that places higher importance on free cash flow than on profits. However, there is a small problem.Amazon’s cash flows suck. This may surprise you considering all the data that we just discussed above. Amazon’s “sustainable” cash flow is not as strong as reported in its financial statements and there are several factors which artificially inflate its reported cash flow performance.

1. Stock-Based Compensation (SBC)

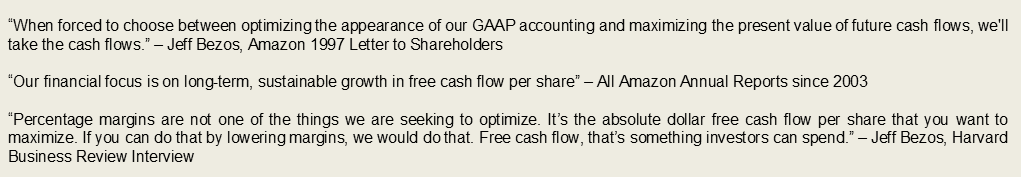

Remember me mentioning earlier that Amazon has not raised any external equity capital since its IPO? That was a slight misdirection. While Amazon has not raised any external equity capital, it has raised a fair bit of capital by selling its shares (Outstanding shares have increased from 412 million in 2005 to 465 million in 2015). However, you would not have heard of any of these fund raises because Amazon raised this capital from its employees who were partially compensated through stock options. While there is nothing wrong with this practice, it does artificially inflate the reported FCF of Amazon.

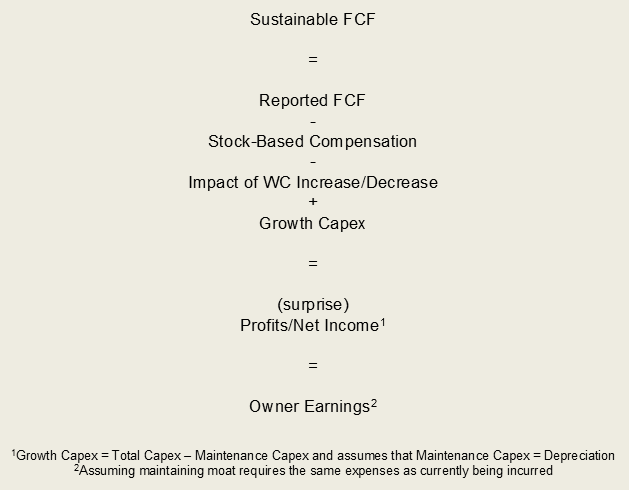

As SBC is a non-cash expense, US GAAP allows companies to exclude it from their reported FCF calculations. So, a company that has a significant share of compensation in stock options will have a higher reported FCF than a company that does not have SBC. The same company can have very different reported FCF depending upon its internal compensation policies. However, a change in compensation policy would not suddenly change the economic value of the company as the underlying business is the same. Therefore, sustainable FCF used for valuing a business should not include the non-cash SBC which inflates the reported FCF.

Amazon’s cash flow has been a big beneficiary of its usage of SBC. Amazon has spent $ 5.9 billion in SBC over the last 10 years and its usage of SBC has increased substantially over the last few years. Amazon spent over $ 1.5 billion in SBC in FY15 which is a fairly large amount compared to the reported FCF of $ 1.8 billion.

2. Negative Working Capital Cycle

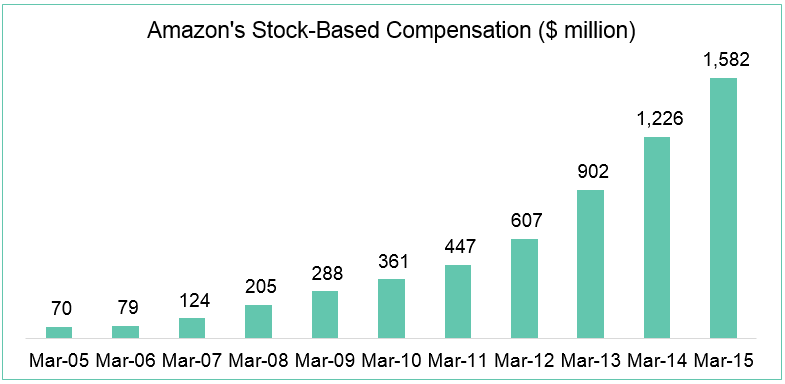

Amazon operates on a negative working capital (WC) cycle i.e. it pays its suppliers a few days after it collects the cash from its customers. This is a common feature of any large retail (or e-retail) business. The retail business model is often referred to as a business where money is made from suppliers and not customers.

A negative WC cycle allows fast-growing companies to generate positive cash flow for a long time as they collect cash from customers and pay their suppliers later. For example: If a company needs to pay its suppliers 6 months after it collects the cash from its customers and is growing its revenues from $ 100 million to $ 150 million, the company would generate a positive cash flow of 6/12 x (150 – 100) = $ 25 million purely because of its negative WC cycle. Amazon has been a big beneficiary of its negative WC cycle and has generated $ 5.9 billion in positive cash flow over the last 10 years just because of this trait of its business model.

While a negative WC cycle reflects the strength of a business model, its impact on the cash flow should be excluded from the FCF calculations. This is because a negative WC cycle is only beneficial in periods of growth. As Amazon’s growth slows, the beneficial impact of the negative WC cycle on the cash flow will reduce and finally become zero when Amazon stops growing. As such, cash flow due to a negative WC cycle has no impact on sustainable FCF (the metric Bezos is focused on)[i] and should be excluded.

In FY15, Amazon had a positive cash flow impact of $ 1.5 billion due to its negative WC cycle. Again a large amount compared to the reported FCF of $ 1.8 billion.

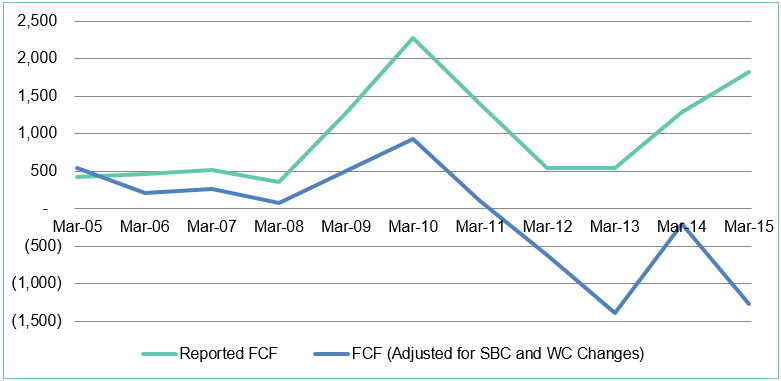

As can be seen from the charts above, Amazon’s reported FCF has been boosted by SBC and its WC cycle which do not have an impact on sustainable cash flows. If we adjust the reported FCF for the impact of SBC and WC changes, the adjusted FCF is a negative $ 1.3 billion. It’s clear from the below chart that for several years now Amazon has not even managed to generate a positive FCF.

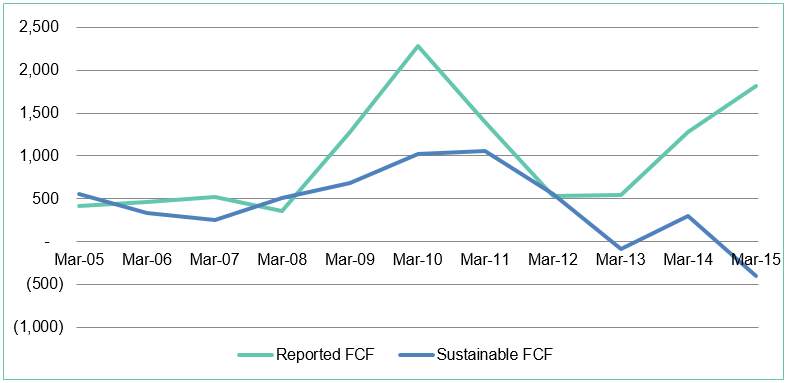

The adjusted FCF calculated above is understated as it penalizes Amazon for its entire capex – a part of which may be growth capex[ii]. While it is difficult to exactly calculate the growth capex portion, we can broadly assume that Amazon requires $ 1 of maintenance capex for every $ 1 of depreciation and what remains is growth capex. Adding the growth capex to the adjusted FCF calculated above gives us the sustainable FCF. For Amazon, this number is negative $ 405 million in FY15. Amazon’s sustainable FCF seems to have a declining trend.

It might surprise a few readers that the Sustainable FCF calculated above is the same as the Profit or Net Income reported by Amazon. Indeed,sustainable FCF and Profit are the same.

So if sustainable FCF and Profits are one and the same, why the obsession with cash flow? There are very good reasons for this obsession. Profit is largely an accounting metric and can be easily manipulated as there is a fair bit of subjectivity involved in all accounting. Unethical managements have time and again defrauded investors by reporting artificially high profits by manipulating accounting Revenues or Expenses. Some of the biggest accounting scams globally (Enron, Worldcom, Tyco) involved usage of creative accounting to fool investors. On the other hand, cash flow is fairly difficult to manipulate as it reflects the very real inflows and outflows of cash in the bank account. Naturally, investors who have been burnt several times by unethical managements misreporting their profits have gravitated towards relying on cash flow as a measure of the health of the company.

However, cash flows are a better predictor of business health only if there are doubts about management integrity. In almost all other cases, Profit is a better metric to understand the business. As there is no reason to doubt Amazon’s accounting quality, we should therefore be looking at its Profits rather than cash flows. By focussing on the reported FCF (which has always been spectacular), analysts are focussing on an inflated number which does not reflect the sustainable FCF (or Profits) of Amazon.

Reported FCF is Magician Bezos’ top hat which allows him to take out a rabbit, eggs, flowers or anything else that might mesmerize the audience. All he needs to do is change the compensation policy towards stock options or tweak the working capital policy. We should instead look beyond the façade and refuse to get swayed by the magician’s sleight of hand.

–

[i] Buffett fans might have noted that Buffett does not include the cash flow impact of working capital changes in the calculation of Owner Earnings.

[ii] Benedict Evans had argued that the recent FCF of Amazon is depressed due to a significant increase in capital expenditure in order to capture the large e-retail opportunity. He has also argued that Amazon’s business has not become more capital-intensive. However, there does exist data that supports the argument that Amazon’s business has become more capital-intensive. Amazon’s depreciation has also been growing in-line with the increasing capex. In FY15, capex increased to 6.5% of Revenue and depreciation increased to 5.6% of Revenue in FY15. Depreciation was 86% of capex in FY15. So unless Amazon has a very conservative depreciation policy, a large part of the Company’s capex is primarily maintenance capex and not growth capex.

Disclaimer/Disclosure: This post is not a recommendation to buy or sell Amazon stock. Please do not base your investment decisions on this post. I do not have any position on Amazon stock.

VarSep

Taking lead from your discussion, I just bounced this idea of SBC with a friend of mine and we were wondering comparing FCF per share over the years should solve the discomfort isn’t it.

Amit Mantri

FCF/share is a better metric as it adjusts for SBC. However, FCF/share would widely vary depending on how pricey the stock is. For example, if AMZN decides to increase the SBC component at current valuations the increase in FCF would be much higher than the dilution in shares resulting in an artificially high FCF/share. So the ideal way is still to compare FCF minus SBC.

FCF/share would also need to be adjusted for working capital driven cash flows in the growth phase.

VarSep

Got it, AD summed it up brilliantly here

http://aswathdamodaran.blogspot.in/2014/02/stock-based-employee-compensation-value.html

Amit Mantri

Thanks for sharing. Perfectly explained.

Anonymous

Hello, a question regarding your analysis. While I agree with your logic that Cash Flow from SBC & a negative WC cycle is not sustainable, in my view it is wrong to remove them from FCF; A better way would be to remove their effects from OCF calculations and move the respective line items to CFI no?

Wouldn’t it make more intuitive sense to look at a negative working capital cycle as an investing cash flow, rather than remove the thing. One can argue that cumulative investment in the company had been funded by it’s negative working capital and reflects the underlying traits of it’s business model, same goes SBC no?

While I agree that it would be wrong to extrapolate past FCF generation with future FCF generation assuming a no growth scenario, don’t you think its unfair to remove the same entirely from historical FCF, since by definition that is a cash inflow for the firm. Also, the fact that Depreciation was 85% Capex was very surprising, guessing that some part of Capex gets reflects in the company’s opex( given that it’s a tech/software) business.

Overall though agree with broad thinking, just don’t agree with- “it’s clear from the below chart that for several years now Amazon has not even managed to generate a positive FCF.”

Geordie Job Pottas

Thank You for this piece of wisdom! Mesmerized!

VarSep

I thought it is apt to see this paper to adjust the CFO or FCF for expenses which have long term impact (read “Technology and Content” head in case of Amazon)

https://www.fundresearch.de/fundresearch-wAssets/sites/default/files/Nachrichten/Inside/2017/Time%20to%20Change%20Your%20Investment%20Model.pdf

Amazon’s 2018 annual report states “Technology and content costs include payroll and related expenses for employees involved in the research and development of new and existing products and services, development, design, and maintenance of our stores, curation and

display of products and services made available in our online stores, and infrastructure costs. Infrastructure costs include

servers, networking equipment, and data center related depreciation, rent, utilities, and other expenses necessary to support

AWS and other Amazon businesses. Collectively, these costs reflect the investments we make in order to offer a wide variety of

products and services to our customers.”

Clearly accounting standards asking to expense out such spends each year appears wrong. Further even if amazon stops spending the same from next year, accounting profit will shoot making all market liked metrics rise CFO/FCF/EBITDA/PAT.