“The reason why it is so difficult for existing firms to capitalize on disruptive innovations is that their processes and their business model that make them good at the existing business actually make them bad at competing for the disruption.”

– Clayton Christensen, The Innovator’s Dilemma

Over the last few months, it has become clear that the funding frenzy that led to the rapid growth and emergence of hundreds of tech start-ups is beginning to lose steam. The talking points have changed from “large market size” and “growth at any cost” to “profitable unit economics”. Drying up of easy capital has led to several companies scaling back their expansion plans and focusing on profitability. Despite the funding slowdown, India is now home to several tech unicorns (fancy word for a company valued a billion $s or more) which have raised humongous amounts of venture capital funding. However, as the underlying businesses of these unicorns are far from profitable, a weaker funding environment will probably lead to several unicorns being forced into consolidation or risk becoming unicorpses (fancy word for dead/bankrupt unicorns).

While the challenges of the loss-making unicorns are well known, this post is about India’s most profitable unicorn and why it could potentially be India’s first unicorpse.

Just Dial (JD) is India’s largest local search services company. In 2013, JD became one of the most successful VC-backed Indian companies to go public, with a market capitalization of US $600 million. Post its IPO, JD’s market cap rose to over US $2 billion making it one of only three publicly listed Indian tech unicorns (along with Info Edge and MakeMyTrip). JD’s business model was extremely profitable and capital efficient. Over the 2008-2015 period, JD’s revenues increased by 9x while profits grew by 80x. Unlike the commonplace multi-million $ cash burns of tech startups, JD did not even utilize the capital raised from VCs, as it was always profitable.

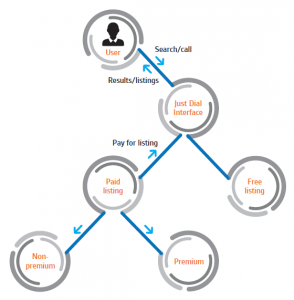

Just Dial Business Model

However, things have changed over the last 24 months. JD is facing multiple threats to its core search business model which have impacted its revenue growth and profitability. JD has not helped its own cause by taking some truly bizarre decisions and with a weak response to emerging competition.

Unbundling of Just Dial

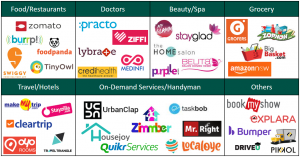

JD’s biggest threat has been from the rise of vertical-specialists offering search and transact services. The unbundling of JD has been a key focus area for emerging tech startups and has received fairly large investments from VCs. While JD’s advantage lay in its proposition as a one-stop shop for all local search, this proposition is being disrupted by vertical specialists who are offering a better user experience and an ability to transact in addition to search. JD’s horizontal focus has limited its ability to maintain its market share in large vertical categories. For example, Zomato is now the clear market leader in restaurants category. The likes of Practo, UrbanClap and HouseJoy are also gaining market share in categories such as doctors and handyman listings, at the expense of JD.

Rise of the Vertical Specialists

JD’s management maintains that it has not been impacted by vertical players (referring to those that disagree as “immature analysts”). However, this only seems to be a case of management living in denial. Restaurants and Doctors are probably the largest markets for JD based on the top positioning of these categories on the website and app. A simple search on the app reveals that the Restaurants category has a higher number of paid listings than any other category for JD.

We ran a quick poll (with 200+ responses)¹ to understand JD’s general usage trends and user preferences in its most popular categories (Restaurants, Doctors and Movies). The results showed that users who preferred JD were insignificant compared to the respective specialist leaders in the category (Zomato, Practo and BookMyShow). Losing market share in your largest categories should be a cause of concern for any company. The unbundling trend may lead to more market share losses as well-funded vertical specialists aggressively target the largest and most profitable segments of JD’s business.

Poll Result: Preferred App/Website By Category

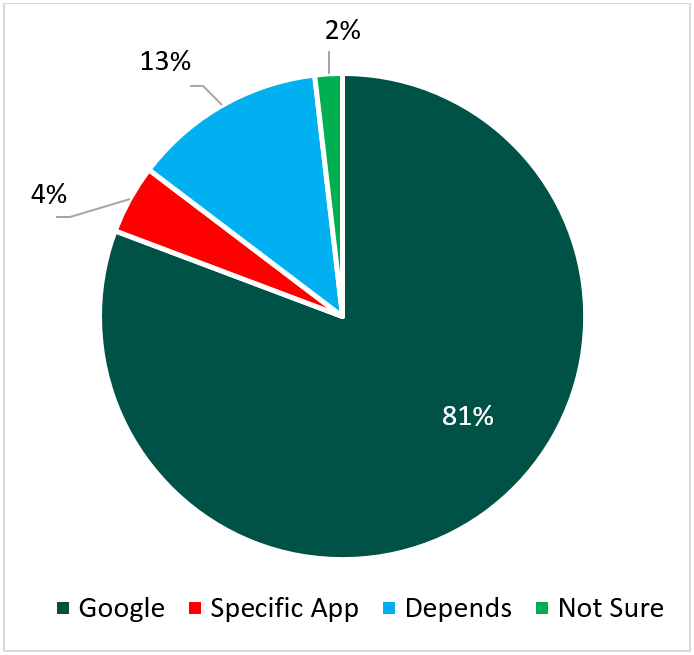

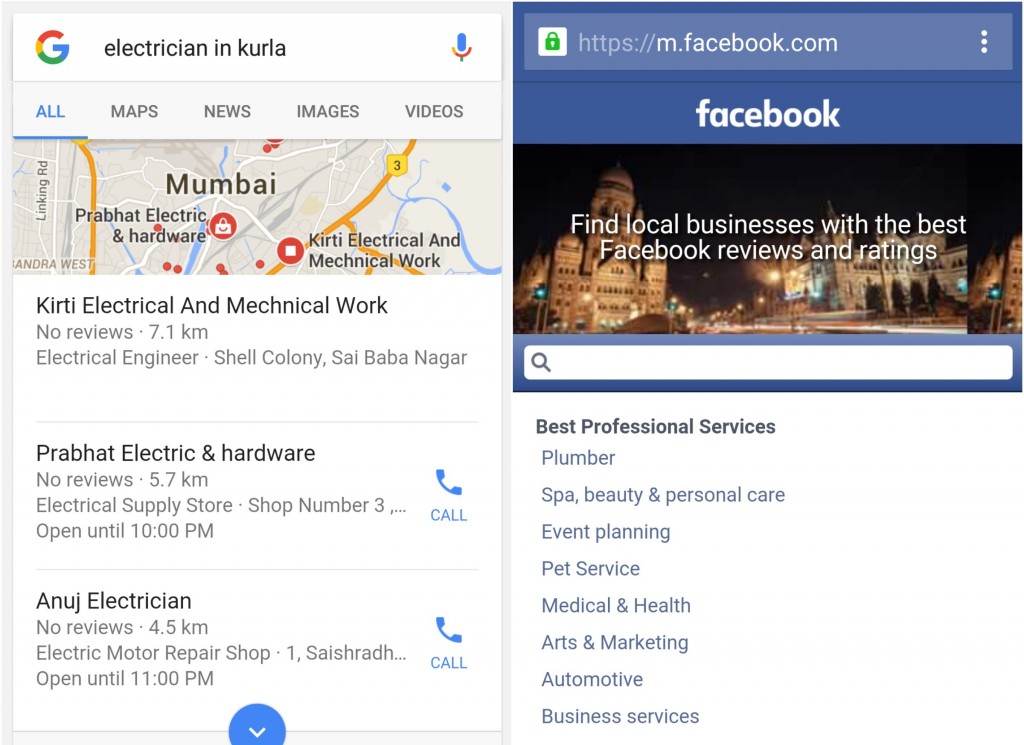

Entry of the Big Boys

JD’s leadership in local listings is also being challenged by internet biggies like Google and Facebook. Google My Business (Google’s business listing service) has begun to rapidly increase its presence in India as it seeks to provide better local search results. JD is dependent on Google for a large share of its online traffic as most users (>80%) start their search on Google and then click on a JD link in the search results. This traffic is at risk as users’ local search queries are increasingly serviced by Google itself. In 2015, Yelp (US’ largest business listing and reviews site) saw a big drop in its user traffic when Google search prioritized its own results over those of Yelp.

Poll Result: Where do you start your search for local business information?

Facebook has recently launched local business listings in India which will directly compete with both JD and Google. For local businesses, Google and Facebook are additional sources of free leads which reduces the value of paid listings on JD. The rise of Google and the entry of Facebook pose a serious threat to JD’s core search business as both these players already have a large user base in India and deep pockets to aggressively grow the local listings business.

Entry of the 800-Pound Gorillas

Weak Execution

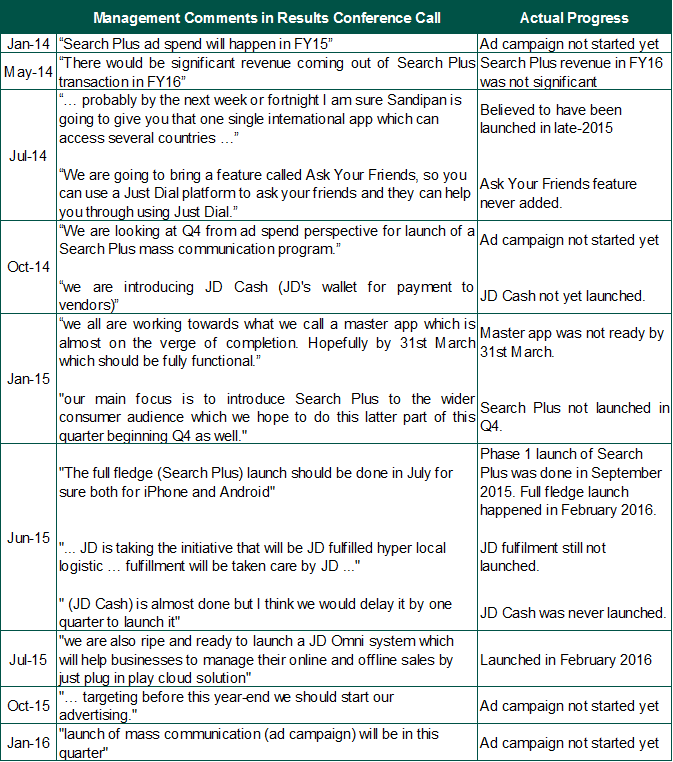

While competition has been continuously launching new products, JD’s response to the rising competition has been rather laid back. JD announced the launch of Search Plus providing search + transact services in early 2014. This was expected to be a game-changer for JD effectively tackling the threat from vertical-focused apps. However, the actual launch of Search Plus has seen inexplicable delays that has allowed competition to gain a strong foothold. JD’s ad campaign which was initially expected in FY15 has still not been launched. JD’s management has been providing new timelines for the ad campaign in almost every conference call over the last two years. Other products announced by management like JD Cash, JD Omni, common international app and JD Fulfilment have also been significantly delayed.

Multiple product cancellations and long delays in launching key products raises serious concerns about JD management’s ability to plan, execute and stay relevant in a fast-changing digital world. JD’s weak execution over the last two years is also reflective of the challenges that a people-intensive phone-based search business is having in transitioning to a tech-intensive business. JD began by providing local search services on the phone in 1996 and started their web-based search services only in 2007. With web and mobile now accounting for more than 85% of the visitors, the strengths of its past may no longer be relevant for its future.

Declining Usage Trends

In Q3 FY16, JD’s unique visitors grew by over 13% while JD users using mobile internet increased by 34%. As per IAMAI, India’s internet user base is estimated to have grown by 49% in 2015 with mobile user growth of over 74%. JD’s user growth significantly lags the growth of the Indian market. This suggests that a lesser number of the new internet users in India are using JD. Our poll suggests the usage of JD has declined even among older users – with 52% users reporting a decrease in usage over the last 2 years compared to only 16% reporting an increase. Weak user growth and declining usage trends are reflective of the major shift towards alternative search options (vertical specialists/Google).

Buy-back Fiasco

While slowing growth and rising competition are challenges, JD has not benefited from some bizarre decisions made by the board/management. In June 2015, JD announced plans to use its cash balance to buy-back its shares. As per JD management, this was being done to reduce the cash which was piling up on its books. However, this came only 6 months after JD had expressed its intentions to raise 1000 crs for M&A purposes and to fortify its balance sheet. It is not clear how in a short period the company went from needing capital to strengthen its cash position to returning cash to shareholders via a buy-back.

Buy-backs are typically done by mature companies in slow growing industries which face investor pressures to return excess cash. A buy-back also does not allow a company to raise any new capital for a 6-month period. In a dynamic environment where capital is being used as a source of competitive advantage, it made no sense for JD to buy-back its shares thus reducing its cash position and also limiting its ability to raise new capital if needed. JD would have been much better placed with a stronger cash position in view of the threat from well-funded competitors.

JD’s founders tendered their shares in the buy-back which is quite unusual. Management selling shares is often considered a negative signal as they have the closest view of the underlying trends of the business.

Just Dial’s MySpace moment?

JD benefits from a two-sided network effect – a large number of listings attracts more users which attracts more listings and so on and so forth. The presence of this network effect had led to the emergence of JD as the dominant local search services company in India. Network effects are the reason why tech companies are valued so highly. The No.1 player often enjoys more than 100% of the industry’s profit pool.

While network effects yield a strong competitive moat to the market leader, the barriers are not insurmountable. Over 2005-2008, MySpace was the world’s largest social network and benefited from a one-sided network effect – an increase in users directly increased the value of the network for the other users. However, the emergence of Facebook saw users leaving MySpace and quickly shifting to a better social network. MySpace was never able to regain its lost mojo and was eventually sold for US $35 million in 2011 (a fraction of its rumoured peak US $12 billion valuation).

JD’s story could very well resemble that of MySpace – a dominant leader being disrupted by a better mouse trap. Of all the Indian tech unicorns, only JD is threatened by disruption while the others main struggle is to build a profitable business before they run out of cash. While funding challenges can be temporary, JD’s woes of an outdated business model and weak execution seem permanent. As such, it should not come as a surprise if India’s first unicorpse is today’s most profitable consumer internet company.

–

¹Detailed poll results can be seen here – JD Poll Summary

Disclaimer/Disclosure: This post is not a recommendation to buy or sell Just Dial stock. Please do not base your investment decisions on this post. At the time of the publication of this post, we/related parties have a short position in Just Dial.

Tuhin Chatterjee

Very nice post Amit… Agree that JD is losing mindshare among its customers – would love to know, what would be your advice to JD management – Better execution and …

Amit Mantri

Few things that could make a difference –

1. The consumer is changing. Listings alone is not sufficient, they need to provide reliable transaction completion. That will require them to build capabilities which they don’t have currently but needs to be done. Sulekha which was a no.2 in listings has pivoted on these lines. They are focusing on a few categories. Considering JD’s dominance they can do a better job than Sulekha if they try. If not, the likes of Sulekha, HouseJoy and UrbanClap will take their market.

2. Focus on a few things which are natural extensions. Currently JD is doing a 100 different things and is a complete mess because of the lack of focus. Their entry into e-comm does not fit with their current strengths. JD Omni similarly is not a natural extension. They should have ideally been far ahead of Zomato and Practo in restaurants and doctors but they ignored these categories. They are still far ahead in lots of other (potentially large) categories. Just focusing on those categories should still be enough.

3. Replace current management and get new ppl who have a tech DNA. JD’s current products have an absymal UI/UX compared to competing players. In the digital world, that’s unpardonable. Doesn’t look like the current management even understands this. Replacing them may just lead to better products from JD.

How well they execute would eventually determine their future. They are still the dominant classifieds player in India. That’s an advantage most of the new entrants don’t have. Last 2 years have been a disaster in terms of execution. Next 2 years execution will determine if they regain their past glory or die.

Prince

CFO/senior team have quit recently

Also, ironically JD managements (everywhere) are notorious ( http://bit.ly/294UPtL )

Rajesh G

Just Dial is losing it’s game – and the worst part is that they do not want to admit it either.

Just Dial is trying too many things with too little a focus on any vertical. None of the verticals could be in top 10 competing apps in the same domain. In fact, the arrogance of management is visible from the fact that two of their CTO’s have left the company in less than a year span (which is very critical for a so called aspiring “Tech” company).

Saurav

Kudos to your research team. Found all the analysis of kitex, justdial, manpasand very good.

Found another article worth sharing here on the buyback fiasco of justdial. https://sentimentsbubbles.com/2016/08/28/stock-buybacks-good-bad-ugly/