Building strong consumer brands is hard. Building them at scale is even harder. Especially in the food and beverages market, building a new brand can be exceptionally difficult. A new player must garner market share from incumbents that have (1) a high brand loyalty amongst consumers, (2) a large distribution footprint built over decades, and (3) benefits of scale due to a portfolio of brands (distribution, advertising, overheads etc.). This explains the resilience of brands like Maggi and Coca Cola which survived the lead and pesticide controversy respectively. Over the last 10 years, the number of new brands built in the food and beverages segment are quite low.

There have been a few exceptions though. For instance, Paper Boat by Hector Beverages has been quite successful. However, Paper Boat’s success was driven by its creation of an entirely new product category of ethnic drinks. Paper Boat did not directly compete with any existing player. It has built a loyal customer base by targeting a latent consumer need which was not served by incumbent players. However, Paper Boat is still a niche product and generated less than 100 crs in revenue in FY16. Other success stories (like that of DS Group’s Pulse candy) have primarily been in segments with higher market share churn.

However, there is one company which is truly an exception – Manpasand Beverages (“Manpasand”). Manpasand is a Baroda based company which sells fruit drinks/juices under the Mango Sip and Fruits Up brands. In a short period, the company has seen rapid growth in revenues and profits. In FY16, Manpasand generated 557 crs in revenues and 51 crs in profits. This growth was achieved despite fierce competition from incumbent players like Coca Cola (Maaza), Pepsi (Slice/Tropicana), Parle Agro (Frooti) and Dabur (Real).

Manpasand Financial Summary

| in Crs | FY12 | FY13 | FY14 | FY15 | FY16 | CAGR |

| Revenue | 85.7 | 239.8 | 294.3 | 359.8 | 556.7 | 60% |

| PAT | 6.1 | 22.4 | 20.5 | 30.0 | 50.6 | 70% |

Manpasand’s growth has attracted a lot of interest from both private equity and public market investors. Over 2011-2015, the company raised 116 cr from private equity investors. In July 2015, it went public with a 400 cr IPO. Manpasand’s stock has delivered a 90%+ return over its IPO price. Manpasand seems to have done the impossible by building a large and highly valued beverage brand despite competing head-on with entrenched foreign and Indian players.

But, there’s a catch.

It’s not clear how the company generates its 550 crs in revenues (650 crs if you consider the trailing 12 months’ performance). There are several other red flags as well. Read on.

1. The curious case of Manpasand’s (surprisingly) high market share

The packaged fruit juice market in India is estimated to be in the range of 9,000 to 12,000 crs in value terms (including retailer and distributor margins). Mango juice is the largest category accounting for ~85% of fruit juice sales. Maaza, Slice and Frooti dominate the fruit juice market with over 60% market share in volume terms.

Fruit Juice Volume Market Share

| Brand | Company | 2015 Market Share % |

| Maaza | Coca Cola | 28.8% |

| Slice | Pepsi Co | 19.4% |

| Frooti | Parle Agro | 15.5% |

| Real | Dabur India | 8.8% |

| Tropicana | Pepsi Co | 5.8% |

| Others | – | 21.7% |

| Total | 100.0% | |

Source: Manpasand QIP Document, Euromonitor

In FY16, Parle Agro (Frooti owner) and Manpasand generated 1270 crs and 550 crs in revenues respectively from fruit juice. Considering Manpasand’s higher trade margins (35% vs Parle Agro’s 25%), it was already 50% the size of Parle Agro in FY16 (in volume terms). It also has a negligible presence in South India which accounts for ~25% of the fruit juice market. So essentially, in North, West and East India, Manpasand was 60%+ of Frooti’s scale in volumes.

This is a phenomenal achievement considering Parle Agro’s Frooti is a 30-year old brand with a large advertising budget and extensive distribution reach. On the other hand, Manpasand spends precious little in terms of advertising and has a limited retail reach. How then did this company achieve such a large scale in such a short time? Manpasand claims that it focuses on rural and semi-urban markets which are underserved by larger players. This is clearly an exaggerated claim. The likes of Coca Cola, Pepsi and Parle Agro have a retail presence in every nook and corner of the country (either directly or through the wholesale channel). Manpasand does not have any advantage that allows it to better serve semi-urban or rural markets compared to a Parle Agro.

To check Manpasand’s claims on its distribution strengths, we did a telephonic survey of 100+ retailers across states like Gujarat, Punjab, UP, Uttarakhand and Bihar. These states are considered Manpasand’s core markets as the company has plants in Baroda, Varanasi and Dehradun and has a higher distributor density in these states (as per its IPO documents).

The survey results show that Manpasand has negligible retail penetration in even its core markets. Less than 10% of the retailers carried Manpasand’s products while the number was ~50% for Frooti (NOTE: Most retailers stock multiple fruit juice brands. The survey was conducted before the demonetization event). It can be reasonably concluded that Manpasand’s retail presence would be even weaker in its non-core markets (like North East, MP and Orissa). How has Manpasand reported more than 50% of Parle Agro’s volumes despite a significantly lower retail presence in even its core markets?

The company claims to generate a part of its sales from the Indian Railways/IRCTC vendors. Could this explain Manpasand’s large scale? Seems unlikely. All large players have similar tie-ups with IRCTC. As of 30th Sept 2016, Fruits Up (accounts for ~20% of Manpasand’s revenues) had not yet been approved by IRCTC. Additionally, Mango Sip is only classified as a “Category A” supplier by IRCTC while Maaza, Slice and Frooti are all classified as “Category A Special” suppliers. This means that Manpasand is not allowed to sell its products on premium trains while competition can. Clearly, Manpasand’s competitors are better placed in selling on the Indian Railways.

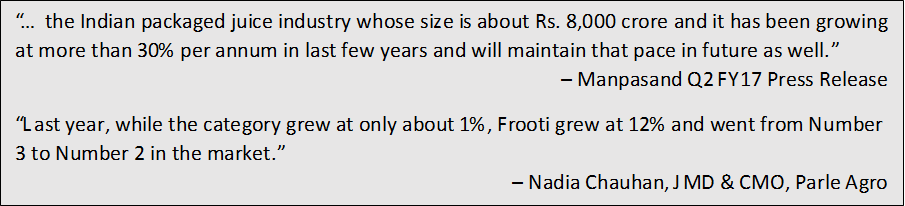

Manpasand’s claims of market growth rates also seem to widely differ from those of competition.

All the above data points are inconsistent with Manpasand’s reported numbers. Where does the company sell its products that leads to such a high market share? Why is its retail penetration so weak in even its core markets? How has the company achieved this scale without any significant advertising spend? Why are category growth estimates of Manpasand and Parle Agro so widely different?

2. The curious case of Fruits Up’s market leadership

In July 2014, Manpasand launched its non-Mango products under the Fruits Up and Manpasand ORS brand. Fruits Up comprises (1) fruit-based carbonated drinks (think Appy Fizz, not Mirinda) in grape, orange and lemon flavors (2) fruit drinks with higher fruit content in apple, litchi, guava, orange and mango flavors. Fruits Up and Manpasand ORS together generated over 115 crs in revenues in FY16 (i.e. in less than 2 years of launch). In Q2 FY17 alone, Fruits Up is reported to have generated revenues of over 40 crs.

While Mango Sip’s success has been remarkable, that of Fruits Up is stunning as it comes in a niche product category of fruit-based carbonated drinks. Parle Agro’s Appy Fizz (launched in 2005) was largely responsible for creating this category and is considered the clear market leader. However, if Fruits Up’s numbers are to be believed it is already larger than Appy Fizz. This has been again done without any advertising support while Appy Fizz has run national TV ad campaigns featuring Priyanka Chopra. As per a sell-side analyst report, Fruits Up was present only in Gujarat and Maharashtra till mid-2015. This raises an important question – How did Fruits Up become larger than Appy Fizz without investing in advertising and with a much smaller geographical footprint? That too within 2 years of launch.

3. The curious case of Hansraj Agro Fresh

Manpasand’s IPO documents had an interesting disclosure which was missed by the analyst community.

SEBI requires companies to disclose if they or their family members have any interests in competing businesses. This ensures that investors are aware of any conflict of interest of the Promoters/Managers of a company. Companies with Promoters having competing interests is considered negative from a governance standpoint.

Mr. Satyendra Singh (MD’s brother) and Ms. Renu Singh (MD’s wife’s sister) are the Directors of Hansraj Agro Fresh (started in 2014) which manufactures the same products as Manpasand.

This information should have been disclosed in the IPO offer documents. This information was not disclosed in even the recent QIP documents. Promoters choosing to not disclose the existence of a competing business run by immediate family members is a serious red flag. A LinkedIn search shows that ex-employees of Manpasand now work for Hansraj Agro Fresh. As such, it is unlikely that the company was unaware of the existence of Hansraj Agro Fresh. The company claims that “we have been unable to obtain any information pertaining to themselves or any such entities”. Maybe, the company has not yet heard of Google or ROC search (see here – https://goo.gl/dtVh40)

4. The curious case of the 500-cr QIP

In September 2016, Manpasand raised 500 crs through a Qualified Institutional Placement (QIP). This was after it had just raised 400 crs through an IPO in July 2015. Companies rarely need to raise additional capital so soon after an IPO. As per SEBI data, Manpasand had the smallest time gap ever between its IPO and its QIP. There must have been good reasons why the company needed to raise such a large amount of capital in such a short time after its IPO. The “Use of Proceeds” outlined in the QIP document was as follows:

Well, that seems a bit vague. Basically, the company is saying they can do whatever they want. Just give us the money.

Such a large fundraise so soon after the IPO is odd for several reasons. The company used 100 crs of the 400 cr fundraise in the IPO for repaying its debt. This suggests that, till a few months back, the company considered debt repayment a better use of proceeds than investing in growth opportunities. As of 31st March 2016, the company still had over 90 crs in cash to continue to invest in growth and expansion. In case that was not sufficient, it could very well have raised debt again. With this QIP, Manpasand has raised over 1000 crs in equity capital over a 5-year period!!

5. The curious case of Manpasand’s low employee compensation

Building a large business is rarely a one-man show. While the company can be led by a visionary CEO, it still needs a strong management team to execute the CEO’s plans. Compensation ends up playing the most important part in hiring and retaining a good senior management team. This does not seem to apply to Manpasand which has abysmally low senior management compensation.

| Name | Designation | Age | Tenure | Annual Compensation (in lakhs)1 |

| Paresh Thakker | Chief Financial Officer | 40 | Inception | 6.5 |

| Bhavesh Jingar2 | CS & Compliance Officer | 30 | 2014 | 4.2 |

| Vijay Panchal | Chief Controller of Operations | 43 | Inception | 9.8 |

| Shaunak Bhavsar | Finance Manager | 47 | Inception | 7.0 |

| Chintan Chokshi | Regional Sales Manager | 28 | Inception | 4.6 |

| Praharsh Vaccharajani | General Administrator/PR Officer | 34 | 2013 | 5.1 |

| Girishkumar Pandya | Credit Monitoring/Collection Manager | 32 | Inception | 3.3 |

| Surender Sharma | Logistics Manager | 54 | Inception | 3.6 |

| Dipan Thakkar | Product Manager (Fruits Up) | 33 | 2014 | 3.5 |

| Sardul Pandit | Plant Head | 28 | 2015 | – |

| Median | 4.6 |

1For FY15 2Annualized figure

In FY15, Manpasand’s median senior management compensation was 4.6 lakhs!! Such low compensation for senior management of a company of this scale is completely unheard of. At these compensation levels, how could Manpasand retain these executives who have led a 6x growth in revenues over the last 4 years? Given their performance, wouldn’t competitors look to hire them for even 4-5 times their current compensation? We are unable to comprehend why that hasn’t happened yet.

—

At first glance, Manpasand appears to be an exceptional business operating in an attractive industry. However, a deeper review raises several concerns as discussed above.

Finding good investment ideas in the small and midcap space in India is hard work, especially given the history of poor corporate governance standards. Using screeners on the reported financial statements to find high growth businesses with high ROEs may seem to be the easiest way to find good ideas. However, investors would be better off spending their time understanding the source of high growth. Blindly relying on the company’s reported financials and/or management commentary can be injurious to portfolio returns.

Disclaimer/Disclosure: This post is not a recommendation to buy or sell Manpasand stock. Please do not base your investment decisions on this post. We do not have any position on Manpasand stock.

Dhaval

Hi good update and analysis. Just one small input : Mango Sip is available on Shatabdi train. ( Since you mentioned it’s not availabile on premium trains). With everything else i completely agree with you.

Amit Mantri

Thanks Dhaval. As per IRCTC, Mango Sip is only for non-premium trains. Please refer to this doc – http://www.irctc.com/displayServlet?displayActionFlag=all_pdf&get_file_name=DETAILS_OF_SHORT_LISTED_SUPPLIERS_PAD

Maybe there is some arrangement that still allows them to sell on Shatabdi.

Ravi Mundada

Manpasand Beverages had too discontinued businesses with his old channel partners all over India (80%), because they(company) know that they (channel partners) will not support in wrong decisions.

Kimi

Awesome analysis Amit.

Sudhakar

Awesome analysis

Rahul Kumar

Excellent piece. This should be taken up for investigation by SEBI and if any of this is found to be true with respect to adequate disclosures, the investment bankers need to be questioned. Also time and again its been observed that basing investment recommendation on reported financials and management commentary is very common in India, surprisingly even for smaller companies with several potential red flags. Ostensibly, sell side analysts these days form a favorable bias after a stock has doubled and then rarely make that bold move to question or raise flags in the company strategy or corporate governance issues.

Bhaskar

Awesome analysis. I did see “Fruits Up” in my local heritage shop in Bangalore during summer but obviously it was not selling well and they had BOGO deal going on but did not see any sales. I think you can get more South India specific data from Heritage, More, BigBazar, Spencer.

Anybody investing in new small/mid-cap companies showing phenomenon growth when industry is not showing such growth rates without on the ground scuttlebutt is setting up for failure. Stock is down 10% as of 07/12/2016 10:30 am

Its also become a common practice to prop up the stock price before QIP .. Why cannot regulator investigate such frequent violations is beyond me.

Jayashree

Excellent. I had shares and I sold it off based on this. I had bought into the hype created by the Co earlier. They seem to be managing the prices also rather well.

Lost a bit of money. But am OK as I find the evidence as laid out here quite disturbing. Rather be out of such stocks.

Mrunal Savla

Sir, can you please give your insights regarding :

Whether the company is paying taxes (direct as well as indirect). I assume deloitte (their auditors) would have checked and done cross referencing their VAT returns (C forms etc)

Daljit Singh Kochhar

Did you take any management or auditor input regarding revenue recognition? Do their input costs check out?

Pranav

Superb Analysis. I am glad I came across this masterpiece analysis. Was planning to buy manpasand on dips. Will stay away.

Karan Samal

I was once very interested in buying this particular business, however, the same queries arose in my analysis. The Brands owned by this company doesn’t have a decent presence at retail stores and still the company is growing at an extra ordinary rate. The valuations are too high.

Anyways, can you do a similar analysis on Mirza International? Its brand Red Tape is a premium brand however, why they do not advertise?

parth Talsania

Excellent Work. Truly Appreciating .

Dhruva Pandey

Superb analysis, Very educational too.

Gr8 work keep doing …

RT

A cursory glance of FY16 annual report reflects the following:

Tax paid is very low (~Rs 6 crs on PBT of Rs 56 crs…though there is a MAT credit..still).

The key is to understand the Capex & CWIP….seems there is a mickey in it.

Also in bank FDs, there is ~ 56 crs which is kept as margin money…when there is no debt and no ref to LCs, cant understand why FDs are given as margin money except for Rs 1.3 crs of EPCG liability (incidentally, in CF statement the ref to margin money is 56 crs whereas in BS schedules on cash equivalents the number is 32 crs…may be a typo)

Deval Khandelwal

Hats off man. That was one of the best detailed analysis I have ever read put in such a simple way

Umesh sethi

Superb analysis

Keep up the good work

Proud of you both

????

Sivakumar M

Excellent, typical example of one should not only be considering balance sheet, but should look into various aspects.

Just wondering what could be taken as a base for analyzing the companies if companies start manipulating data!

Good share…

Regards,

Siva

Dipesh Padole

Nice view on the market. But Manpasand has good market in the Tier-II cities and growth of the Company can not be challenged based on just other peers. The Company has proved track record with NIL leverages and it is worth investing in the stock.

Kamal Garg

Very nice and probing analysis.

Lots of unanswered questions.

Have been told that large Indian broking houses and analysts based companies have either strongly recommended and/or invested in Manpasand either through IPO/QIP ( and one such name is Motilal Oswal Financial Services – which is a marquee name in Indian financial services space). Don’t understand why such large institutional investors/analysts cannot take due diligence more seriously and go deep into any investment recommendation case. I agree that excise and VAT paid has to be verified by Deloitte. Why can’t they issue a statement to this effect to allay the fears of some irregularity. Is one more Satyam being created and is in offing.

Why we keep on having such cases in India. Are the regulators and other authorities like SEBI sleeping. And even after these kind of disturbing news coming to the fore, why prices are still OK (fallen from a peak of 770 to 600 as of now during the last 3 months).

Further when can we expect such kind of x-ray or rather forensic analysis of some other companies also.

krish

Even brokers like Karvy who are very careful, had recommended manpasand. There may be many more like this.

Sachin

Awesome analysis

Sachin

?Awesome analysis ?

Susmit

Before we get into the awesome analysis, I wonder why Savi Jain changed his experience at ICICI Pru Life from Investments to Acturial/Investments. Is there a curious case here?

Savi Jain

Dear Susmit

Thanks for keeping such a keen eye on our website changes (one of which you have highlighted). We regularly update our website as you would have noticed.

While at ICICI Pru Life, I was responsible for the Risk Management of the Investment portfolio at ICICI Prudential Life, as part of the Actuarial team. We made this website change to clarify this and to also make it consistent with the Audited Disclosure Document, dated 30th September 2016, on the “Invest with us” page, where it is already mentioned that I worked with the Actuarial Department.

For your reference, while I was at ICICI Prudential Life, I worked in Abhishek Saraf’s team (Currently at Prudential UK). While I was there, I made several presentations to the then CIO (Chief Investment Officer) – Puneet Nanda (Now Executive Director) as part of my role. Essentially, a major part of my role involved running a risk analysis of the Investment Portfolio at ICICI Prudential Life on changes in various risk parameters like Interest Rate, Equity, Credit Rating etc. Sorry, no curious case here 🙂

BTW, are you the same Susmit Patodia, who is a Director at Motilal Oswal Securities? We would love to catch up to discuss some factual errors in Motilal Oswal’s rebuttal.

Regards,

Savi

Ashu Kumar

Hi Savi,

For the sake of the larger audience, can you please point out what factual errors have you noticed in Motilal Oswal’s rebuttal? I have read Motilal Oswal’s rebuttal and did not notice any data/factual errors.

Discl:- I am invested in Manpasand Beverages so my views could be biased.

Aalok

Burn!! 😀

niks

Excellent analysis. Keep up the good work. I wonder how a big fund invested in this co. without such due diligence.

I was planning to buy this stock but was dissuaded by the high P/E ratio. Saved by Graham philosophy!

Read, Learn, Improve – 10-Dec-16 | Random Thoughts of Analyst

[…] Since vast readers of this blog are in some way related to investment fraternity you ought to read this insightful analysis on Manpasand Beverage Ltd that raised Rs400cr through IPO in Jun’15 and another 500cr through QIP in Sep-16 – The Curious Case Of Manpasand Beverages – Link here […]

Rishabh Adukia

Good analysis , keep up the good work.

looking forward to more such insights from you guys, positive ones too.

Rahul Jain

I have been an investor in Manpasand and hence my views could be biased.

Firstly, you completely ignore the size of opportunity.

India’s beverage consumption ranks amongst the lowest in the world and in comparison to China, beverage consumption is at what it was in 1994 and even for Coca Cola’s sales in was at 12 units vs 92 units (global average) now if you account for the climatic variation, global warming, rising per capita etc. India has miles to go.

Now sitting in your air conditioned office, you cannot fathom the desperation to consume fluid when you travel in summers heat when temperatures touch 45-48 degrees. I’ve firsthand witnessed the compulsion and by the way did see Mango Sip on my road trip on a State bus from Sikar to Jaipur in Rajasthan.

Now based on 100 calls to retailers you question how can report so much topline! I would call yours as a curious case of floppy research! Manpansand sells through more than 2lac outlets and btw its a heavily seasonal product. And are you questioning the auditors or excise department or what? Be specific and say that the auditor is a fraud and file a police complaint! Why are you beating around the bush?

Now tell me why would Manpasand care what Parle reports?

Also, please realise this a asset heavy business, you need to buy land, set up plant and machinery etc., you need hard cash. Its first IPO was to repay debt and set up the Ambala plant. The Ambala plant has just started operations and has’nt even completed a quarter of sales and you are jumping to conclusions!

Now, it raised another Rs500cr through qip. So that money would take 12-18 to be deployed. What are you upset about? That they were able to convince long term investors such as Fidelity, SBI etc to raise equity to expand their brand and reach deeper corners of India? Looks like you are more upset about the taste or that you missed investing in the IPO!

Why do you think markets are so efficient that they lap up every salaried person who is available at a less than percieved salaries. So according to you people are like tradable commodities ready to swapped at the next available buyer!

Do me a favour get out in the market, take the train or a bus for a change and visit tier 2 towns in the summer season, it will open your eyes!

Finally, I would end with a quote from Warren Buffet-

“Successful Investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time: You can’t produce a baby in one month by getting nine women pregnant”

Sreekanth

Good luck.

Mayank

“ha ha ha… he he he… ho ho ho…”

This is how i would react if i were Amit Mantri

Ram

Today when I look back, can only laugh at the above comment. AM may have been wrong but he he backed everything what he said with data and reasoning. But you seemed to be an investor who got swayed by emotions

Pankaj Kumar

It seems Manpasand rewards it’s employees with ESOPs on a regular basis. For a growing company, employees are more interested in ESOPs and ready to work for lower salary than market median. Infosys attracted very talented employees with ESOPs offer in 90s. This may be the reason for lower salary for the senior management.

Apurva Shah

Hi, Amit

Good detailed work,

Can you elaborate on following parameters, as you did a very detailed study of the company and industry?

1) If we go by salary of top employees, how can one justify 16 crs of salary for FY16?

2) Have you more digged into capex done in last two years, and how much capacity will be added?

3) When you say asset heavy business, have you studied companies in similar space? Many FMCG companies have adopted asset light model due to exclusive outsourcing tie ups, is it possible in this segment?

4) Have you questioned management about quality of sales / pat growth, primafacie looking at balance sheet, other parameters are not so questionable. Which segment (Retail / institution has more contributed to 60% CAGR growth in last 4-5 years)

Disclosure: I have not invested in the company, these thoughts are just outcome of your detailed study and other readers input.

Regards,

Kushank Poddar

This was very insightful. Fingers crossed to see how the endgame pans out.

Aditya

Nice analysis

rahul agarwal

http://manpasand.co.in/about-us/

this link shows the pdf of their registration with irctc and approval before Sep 2016.

Good work but looks lot of your facts are incorrect…

arun roy

if we read your kitex article it shows that you were doubting their cash. But now if you look at last qtr nos they have paid off they debt by 80-85cr. You should issue a clarification immediately….you cant create panic by just writing whatever you feel like…I am dead sure similar will happen in manpasand…

Disclosure- I don’t own any stock in manpasand and I don’t agree with you analysis of small sample set

Priyank Dhabuwala

Amit – Any idea why the vigilance officer, Vijay Panchal has 80,000 stock options while the CFO and the CS/CCO have only 2,000 and 1,000 stock options respectively?

Rahul Jain

Another classical error in your judgement as Munger points out “One way to mislead yourself, for instance, is to make decisions based on a small sample size and extrapolate the results to a larger population. Another way we fool ourselves is to remain committed to something we’ve said in the past. We might rely on an authority figure or default to what everyone else is doing.”

Manpasand Beverages: India’s faith in anything aam! – The Astute Investor

[…] Experts have recently questioned the rags to riches growth story of Manpasand. Several concerns have been raised about the revenue figures, market share, distribution network, promoter’s […]

Omprakash Vaswani

looks an excellently researched and insightful piece. The main approach that of critical evaluation and analysis validating data presented by company rather than taking that as a start and building the case is something so important for investment analyst which is done wonderfully here. A good and eye-opening read. Many thanks, Amit.

Abhinav

1. The stock is showing good momentum on the back of q-0-q growth and they have been able to reduce the interest expenses over the past two years.

2. It do not have any debt and capacity utilisation is at peak

3. It has good connect in the tier-II & III market and has good market share.

Auditors of the Company are reputed and some analyst has challenged the same, I feel the stock is worth to invest and shall give good return.

Vanlal

You are.right I’m from silchar Assam and never once seen any of their product

Abinav

Assam or North East they may not have coverage but they are having good market in the other part of the country.

Abhinav

Updates on Manpasand Beverages:

> The Co has tied up with Baskin-Robins in March17 which has 550 outlets in 120 cities and this is expected to improve the availability of their product and can gain the market segment in beverage.

> Baskin-Robinks is good vintage (since 1993) and is one of the largest ice cream retail chain in India.

> The Co has also made association with Parle Products Pvt Ltd(Parle-G) for distribution of the mango sip manufactured by them.

> Parle-G has over 4.50 Mn outlets across India and shall help Manpasand to reach the end consumer and both the Co’s shall be benefiitted to cross-promote their products.

In Q4FY17, the Co”s topline has grown by 16% y-o-y basis and profit has grown 22.66% y-0-y basis and the show has shown good momentum.

It seems that the stock is expected to give good return on the back of its performance and other tie-up/association

Ashish Pandey

Fundoo analysis :).

Aditya Maheshwari

Awesome

Sam

Hi, do you have an option to subscribe to your blog posts by email?

Gagan

Awesome Amit!!

Praveen

Very good article for a investor.

D C Jain

Hello,

Please stay away from this company and its products. They have a very unique “marketing scam” model to help boost their revenues particularly from the southern states. They appoint temporary sales team every quarter. The sales team scout for new stockists (mostly first timers), get them to invest anywhere from 5-25 lakhs. The company sends stock (never equal to the invested amount, it keeps a part of the money never to be returned). Once the stock is dispatched the sales team is replaced. The stock would contain 80% half expired or nearing expiry stock and the remaining 20% new stock.

The stockist being new to the business have no idea how to sell such huge stock. Even if he manages to sell it to distributors, they come back to you with complaints about “bad smell”, “solids sticking to bottle bottom”. The company never responds to emails or phone calls. After trying for 3-4 months (by the time the stock expires) and the stockist gives up the fight.

Readers this is not a fictional account but real story of not just one but many stockists in TN and AP. Please save your self.

Thanks

D C Jain

Dhulev

Ground report on an unethical way of doing business. Thanks for unique inputs. I now doubt about capability of Motilal oswal AMC to assess managements. May be the time to stop SIP to MOST 35?

sarang

please analyze indiabulls ventures seems there is a plentiful insider trading happened

Satya Prakash

There are two Companies like this: Himalaya Food International and Sanwaria Consumer. Please analyse those two too.

Ashwin Reddy

Analysis vindicated. Good work!

Indian Voyager

Nice analysis.

However, there is one key advantage and that is cost. This brand is cheaper than the other competitors, and I mean a lot cheaper.

Why will an average middle class Indian customer not buy this brand over Frootis of the world when he knows that taste is practically the same.

Other thing, you’ve mentioned that market data differs between Parle and them. It all depends on the definition of Market that we use. Of course if Frooti didn’t do well they’d find the data showing that ‘market’ itself is not expanding.

In the industry where I work, it’s very easy to slice and dice data and represent in that way.

Other points are well written though, and even if you remove the above two points from your overall analysis it doesn’t take away the conclusion.

Indian Voyager

Oh man, you did this analysis ‘before’ the auditors issue broke out! I just realised that.

Wow!

Roy

Oh No! This is turning out into another Vakrangee. How are companies able to pay income tax and GST when the sales are (mostly) fictional?

Dhulev

WOW, i wish the auditors and the self appointed analysts of Motilal Oswal had read your blog and at least did verification of the red flags that you had raised in your blog. Kudos for the foresight. Superb work

Akshay Bhagwat

You saved my capital. I was watching Manpasand in 2016. Read this article in Dec 2016 when I wanted to buy as it made low that time. Your article opened mt eyes. And today I am happiest person. Thanks a lot.

Sai

Great research I should congratulate you in depth search and giving us a clear picture. It is so fascinating how did u collect all the data

mAAS

Bang on! This is your “I told you so” moment. Respect!

Jayanta

Take a bow Mr. Amit…you warned and predicted it in 2016 and it’s happening in 2018…genius work! Keep it up!!

Bimal Joseph

The analysis is brilliant. If only the regulators also were so vigilant many investors would not have lost their money. Thank you.

JeevikaMI

Really a awesome research

Change my mind in terms manpasand beveage

Vivek

I am reading your post in June 2018 and it all seems to be making so much sense. Manpasand stocks have plummeted to a new low because of financial irregularities claimed by their auditors. Hats off to you for this article long back in 2016. Well done.

krishnendu

Do you have any information about Opto Circuits (is the management solid?). Apart from its high debt position!!!

Srinivas Moorthy

Wonderful analysis , How these five star audit company has been certifying the balance sheet all these years is a billion dollar question?

Ashish Agrawal

Excellent analysis. Please publish more analysis about other companies also. Thanks for excellent work.

Krishna Chaitanya

What a great analysis. It reads like a thriller.

A great learning indeed.

Thank you.

Rajkumar Rathi

Blog posted date is mentioned as ‘DECEMBER 6, 2016 ‘ .. need to correct that

The analysis is good .. but already the fingers are burnt. I’m sure lot of companies are like this, who fudge financial statement

Not justifying the company .. they should get exposed.

Rajkumar Rathi

My mistake the date is correct .. 🙂

kk

In Your Post you mentioned about Hansraj Agro Fresh (started in 2014) but manpasand started in 1998 way older then Hansraj Agro Fresh. If Reliance bother are in Same Business telecom why Hansraj Agro Fresh and manpasand con’t do Same Business .

Pramod

Hi Amit,

Nice work, the stock in question Manpasand beverages was such a huge hit with fancied investors, few reasons I never invested in the stock

1. Never seen their product in any store, only seen a TV commercial featuring sunny Deol.

2. Whats so different in this product that consumers would prefer this over so many seasoned products currently available in the market.

3. Wondered is to so easy to create such a huge business with so much ease in such a short span of time.

Agree with your observations on compensations offered to management, it is laughable. A graduate trainee engineer gets those packages in any Tier 1 company.

From my own experience of losing money in a company called Tree House (stock fell from 500 + to 20 odd rs, a case of classic fraud by the promoters) which had all seasoned investors like Morgan Stanley, Aditya Birla Capital, Omidyar Network,Unilazer Ventures, the family office set up by Walt Disney India chief Ronnie Screwvala, Matrix Partners & a couple of MF’s which made me realize all these Morgan Stanley’s & Motilal Oswals of the world for some reason are not the best sounding board for sound investments.

One thing is for sure there is no substitute for common sense , a lot the points raised by Amit are red flags which need clarification before one invest in any stock.

sudhir

I think your analysis is not correct about Manpasand Beverages. How come they are posting good results after auditors resignation & each quarter awesome performance how is it possible? There is some logic behind it. Please keep on posting the truth. Don’t manipulate to get the stock down for reputed companies like Manpasand Beverages.

Chintan

How did you came up with the volume assumption by comparing revenue and margins? Can you please explain?

Sujit Bhar

As someone said, if it sounds too good to be true, it often is. Hope someone follows this up to its logical end so investors aren’t fooled/ cheated. Will appreciate you keeping us updated on this.

Vaibhav

Great analysis Amit. These scams provide great lessons for investors and points mentioned above provide us with new ways to analyze a company.

While evaluating Manpasand beverages I found another thing that seems intriguing:

Here is something interest that happened in 2017, long before the stock crash in May 2018

a) Manpasand declared on 20th May, 2017 that a board meeting will be held on 29th May, 2017 for submitting the financial results for financial year 2017

b) Management holds a meeting on 29th May, 2017 as promised. Ideally they should submit the results to the exchange by end of the day. Well that was not to happen. Instead the management decided to defer the results.

The results were deferred due to further time required for the review of financial statements prepared under IND-AS and auditing thereof.

As per the annual report FY18, they even paid a penalty of 70,000 Rs for non-submission of financial results within the specified time period.

I think we can count this as a red flag. Management waits until the end of deadline to submit the financial results and then decides that they need more time to review the financial statements. Quite weird.

canadian pharmacy online

It’s difficult to find experienced people in this particular topic, but you seem like you know what you’re talking about!

Thanks