In January 2018, Netflix announced that it had crossed 54 mn subscribers in the US (i.e. 1 in every 2 US households). Netflix achieved this within 10 years of the launch of its over-the-top video streaming services (OTT[1]).

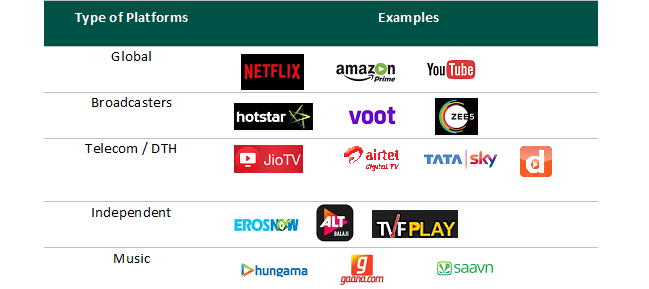

The last couple of years has seen a similarrapid rise in OTT platformsin India that did not exist few years back –

The rise of OTTs coupled with a significant decline in data cost has the potential to disrupt the media landscape in India. All players in the value chain are likely to be affected – distributors (Tata Sky / Dish TV), broadcasters (ZEE / Star), content producers (YRF / EROS / Saregama), and exhibitors (PVR / Inox). The short-term impact may not be visible as the Indian media sector is a growing market driven by favourable demographics, a rise in consumer income and a huge demand for knowledge, escapism, sports and news[4]. However, over the long-term, OTT-led disruption could lead to some traditional playersin the value chain ceding significant share to the new age players unless they change their business models.Some of these OTT platforms in India have already reached a critical scale (Hotstar is estimated to have over 75 mn monthly active subscribers). However, the numbers are stillnowhere near the number of cable households inIndia (~190 mn). One key constraint in the mass adoption of OTTs in India is inadequate infrastructure (low wired broadband and smartphone penetration). In the developed world, OTT is primarily consumed on wired broadband and on TV screens. Indian households have a less than 10%[2] wired broadband penetration. However, with the data revolution triggered by Jio[3], Indians are increasingly consuming OTTs on wireless broadband and smartphones.

- Impact on Exhibitors (PVR/Inox)

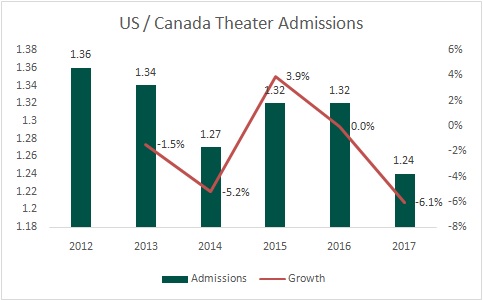

Movie theatre attendance in North America is on a declining trendand hit a 25 year low in 2017. On the other hand, Netflix’s streaming subscriber base in the US has more than doubled in the last 5 years. It is feared that the rise of OTT coupled with quality television and rising ticket prices is leading to a secular decline in movie attendance. Netflix’s strategy of producing films exclusively for streaming without a theatre run may also be impacting footfalls.

Source: MPAA 2017 Theme Report

Rise of OTT platforms could have a similar impact on theatre footfalls in India. Indian viewers can now choose from a large library of films (both new and old) on various OTTs and watch their favourite film at a convenient location and at their preferred time. The one big challenge for global OTTs was how to become relevant in a country where 87%[5] of the total box-office collectionsaredriven by non-English movies. Over the last two years, Netflix and Amazon Prime have tried to address this gap by significantly increasing their local movie content. Domestic OTT platforms like Hotstar have a clear lead here with higher local language content.

| Movies | Netflix | Hotstar | Amazon Prime |

| Hindi | 326 | 615 | 442 |

| Regional | 143 | 2,150 | 399 |

| English / Others | 2,536 | 358 | 795 |

| Total | 3,005 | 3,123 | 1,636 |

Source: www.accessbollywood.net / www.hotstar.com

The comparison between OTT and theatres has become even more relevant with the reduction in the telecast restriction window between the theatrical release and digital release. OTTs are buying the digital rights of the latest Indian movies at exorbitant prices[6]. “Padmaavat” recently released on Amazon Prime within 60 days of its theatrical release and even before a satellite release. It is now possible for viewers to delay theatre consumption of a movie by only a few weeks to watch it at a fraction of the cost with the entire family.

PVR understands this threat and is negotiating with key movie production houses to extend the period between the theatrical release and digital release. In this interview with Anupama Chopra, leading movie producers too acknowledge the OTT threat to the Exhibition business. Ekta Kapoor expects the cost conscious Indian viewers to consume more and more movies digitally and visit the theatres only for the big event films (like Baahubali).

In India, the cost of watching a movie in a multiplex has been increasing every year due to cost inflation and an unfavourable tax regime (GST rates at 28% and LBTs[7] in some states). A Netflix subscription at Rs 200 per license per month (Rs800 for 4 licenses), Amazon Prime at Rs 50 per month (Rs600 for a year), Hotstar at Rs 100 per month and Voot for free are all cheaper alternatives than the cost of a single movie ticket. The cost-conscious viewer now has the option to consume copious amounts of movie content at a much cheaper rate.Several OTTs also operate on a freemium model where a large number of movies are available free of cost. As multiplexes look to expand beyond the metro cities in the cost-conscious Tier 2+ cities, they will need to price their tickets aggressively to compete effectively against the OTTs.

- Impact on Broadcasters (Zee/Star/Colors)

In order to tap the OTT opportunity, all large broadcasters have set up their own OTT platforms (Zee – Zee5, Star – Hotstar, Colors – Voot). While Zee5 and Hotstar are on a freemium model, Voot is free (advertising driven). They have the advantage of ready content (both legacy and currently airing) that they provide on their OTT platforms. In addition, they are spending heavily on creating exclusive digital content.

Non-English content forms93%[8] of total content consumed digitally and is growing at a higher rate than English content. The multi-channel broadcasters (Zee, Star, Colors) have a natural edge in regional content which they have built over many years. However, they lack content focused exclusively on the youth. There is a stark difference in the genre of content between broadcasters and the OTT platforms. Below is a list of 4 of the highest TRP shows on TV, all of which are family / romantic dramas:

| Show | Storyline |

| YehRishta Kya Kehlata Hai (Star Plus) | A family drama showcasing the struggle of a young couple living in a traditional Marwari family |

| Yeh Hai Mohabbatein (Star Plus) | A family drama showcasing divorce, infertility, remarriage, mature love and other societal issues |

| Shakti –AstitvaKeEhsaas Ki (Colors TV) | A family drama based on the struggle of a transgender trying to fight for her rights in the society |

| Udaan (Colors TV) | A family drama about a young girl who is pawned by her poverty-stricken family when in her mother’s womb, as collateral for money |

A large part of the original content on Netlix and Amazon Prime is youth oriented. Some of the recently released / to be released TV shows on leading OTTs are as follows:

| Show | Storyline | |

| Inside Edge(Amazon Prime) | Story of a T20 cricket franchise playing in a cricket league and the corruption involved | |

| Laakhon Mein Ek (Amazon Prime) | Story of the struggle of a student who is forced by his father to prepare for IIT exams | |

| Breathe (Amazon Prime) | An Indian crime drama about a crime branch officer trying to solve an impossible case | |

| Sacred Games (Netflix) | Based on Vikram Chandra’s 2006 thriller novel, the series is about the Mumbai underworld | |

With more than 65% of the Indian population below 35 years, the broadcasters risk losing the younger viewers to OTTs like Netflix/Amazon if they do not make relevant content. In the developed countries too, TV viewing has fallen sharply especially among the younger viewers. Competition from global OTTs is likely to force broadcasters to increase their investments in developing youth-oriented content.

In India, broadcasters’ business models are dependent on ads (70% of revenues). As broadcasters lose their customers to OTTs, there is bound to be a shift in advertising dollars from TV to digital. Digital is already 17%[9] of total advertising spends in India and is expected to be 22%9 of total spend by 2020. Till now the market share gains have come at the cost of Print, with TV advertising dollars remaining intact. According to eMarketer, for the first time since the 2008 recession, TV ad spending in the US has declined 1.5 percent in 2017. It’s expected to decline another 0.5 percent this year and 1 percent in 2019 — three straight years of TV ad-spending drops. It remains to be seen if TV advertising budgets in India (growing till now)follow a similar trajectory.

In a race to acquire the maximum number of subscribers, the broadcasters currently have little focus on monetization of their OTT platforms. A large part of the OTT content is free even in the freemium model. As data becomes cheaper by the day, broadcasters may see some cost-conscious customers shifting their consumption from cable TV to OTTs. In the long term, it remains to be seen whether their own OTT monetization make up for the decline in revenues from cable subscribers.

- Impact on Distributors (Dish TV/Tata Sky/Hathway)

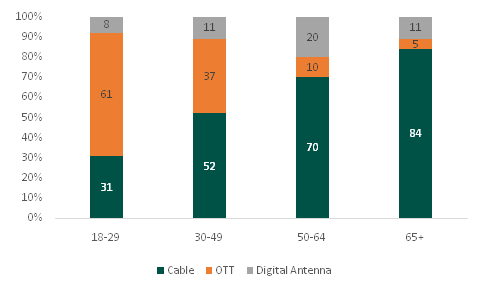

OTT platforms in developed markets like the US and Europe have seen rapid adoption resulting in a sharp decline in traditional TV consumption and often culminating in “cord-cutting”. The decline in TV consumption is especially pronounced among the younger population. A survey conducted in the USA to determine the primary way to watch television for various age brackets showed the following % viewership breakup:

Source: PEW Research Center, 2017

In the 18-29 age bracket, 61% of the respondents already use OTT as the primary way to watch Television. This trend is especially important in the Indian context where a majority of the population is under 30 years of age.

Before the advent of OTT and low-cost internet, media distribution in India was the monopoly of distributors (Digital Cable/DTH players). However there has been an erosion in their value proposition with the emergence of OTT platforms. Cheap internet is accelerating the shift to OTT by emerging as a credible alternate pipe for consuming this media. As broadcasters shift their users to their own OTTs (Hotstar, Voot, Zee5), the role of distributors is likely to be further diminished. The resultant decline in the bargaining power with broadcasters will hurt the already poor economics (one of the lowest ARPUs in the world) of digital cable.

India already has a high cable penetration of ~190 mn households out of a total of 240 mn households. The scope for further penetration is limited for the cable / DTH players. There is also a threat to the growth that was expected from nuclearization of families and from second television connections. As the working youth move out of their homes, they may look at OTTs as their primary connection. Similarly, there is a good chance that OTTs may become the second screen in families that would otherwise have taken a second cable connection.

- Impact on Content Producers (Eros/Saregama/YRF)

“Everybody is bidding for content so as to have the most valuable content. So, the prices now for creators are increasing and there’s more shows and movies produced than ever before”

- Reed Hastings (CEO, Netflix), CNBC TV18 Interview, November 2017

Entry of well-funded global players has led to an arms-race to acquire quality Indian content. There is an opportunity now for Indian producers toproduce quality content with larger budgets. They also have an opportunity to monetize their existing library of content by licensing to content hungry OTTs. In short, Indian content producers have never had a better time:

| Opportunity | Description | Examples |

| Monetization of legacy IP | After decades of no / poor monetisation, IP owners are monetising their libraries by licensing to OTTs | Eros Now, which has a library of 2000+ movies, has reached 5 mn[10] paying subscribers on its OTT platform in just three years of its launch |

| Saregama, which has a song library of 1.2 lac songs, has seen a 40%+ growth last year in its license revenues from OTT platforms like Saavn, Gaana, Hungama, Amazon Prime, Apple Music after decades of no monetisation[11] | ||

| Shemaroo, which has a library of 3,500+ movies, has seen its digital revenues grow at a 5-year CAGR of 44% by partnering with various OTT platforms like Youtube, Jio, Hotstar, Apple, Telcos etc. It gets more than 500 mn views a month on Youtube and gets a share of the advertisement revenues that Youtube makes[12] | ||

| Digital release of films | In addition to satellite rights, Indian movie makers are now selling digital rights of movies for large sums of money | Sanjay Leela sold digital rights of Padmaavat to Amazon Prime for INR 250 mn |

| Amazon Prime has signed a deal with Salman Khan to release all his movies exclusively on their platform two months before the satellite release | ||

| Demand for original content | In a bid to garner maximum subscribers, OTTs have set up large budgets (100s of crores) for creating differentiated content. Production houses are signing content deals to meet this demand | Farhan Akhtar’s Excel entertainment produced “Inside Edge” for Amazon Prime at a cost of Rs 1-2 crore per episode (10x the cost of a typical TV show). Amazon has lined up 18 more original shows with other producers |

| Phantom Films produced Sacred Games will star actor Saif Ali Khan in the lead and will release on Netflix | ||

| Ronnie Screwvala produced Love Per Square Foot, a romantic comedy film was released exclusively on Netflix in 2018 | ||

| New forms of expression | Unlike traditional media, content on OTT is not severely restricted due to time, censorship or advertising constraints | Digital native content makers like TVF and AIB have been tremendously successful using YouTube to create content which would have been unacceptable on traditional media due to the risky socio-political satire and profane language. The OTT medium also allows them to create shows and sketches of non-standard lengths |

| Several stand-up comedians who were hitherto relegated to doing live shows have released content exclusively on Amazon Prime |

Despite their large content budgets, creating content for the diverse Indian audience might still be the biggest challenge for global OTTs. India is a collection of several disaggregated viewer sets with varied tastes depending on language spoken, literacy levels and exposure to western content. For eg. Hindi / English is only spoken by about ~55% and ~15% of Indians respectively. Therefore, content has to be customized for smaller groupswhich reduces the addressable market size. This has resulted in the inability of producers to invest heavily in creating great content (movies or shows). This is unlike North America which has a more homogenized domestic target audienceas well as a large global audience. It remains to be seen if global OTTs can replicate their success in creating exciting original English content in Indian languages as well.

Summary

OTTs have changed the competitive dynamics of various parts of the media value chain. In the long term, the winners will depend on how various incumbents reinvent their business model to continue to be relevant to the consumers. In the short to medium term, the OTT disruption benefits certain incumbents and threatens the others:

- Exhibitors and Cable/DTH: We believe that the OTTs pose an immediate threat to players who act as content distributors only – cable/DTH and exhibitors. The OTTs are acting as alternate pipe for both movies and TV content whose distribution was till now a monopoly of cable and exhibitors. Also, they are now releasing original movies exclusively on their platforms.

- Broadcasters:The broadcasters have an opportunity to capture a large slice of the OTT market by offering their entire content library on OTTs. They have an inherent strength in non-English content that they can leverage to garner subscribers. But they will need to create original youth-oriented content to compete effectively with the global OTTs. There will be a transitory pain as they forgo monetization of their OTT platforms in a bid to garner the maximum subscriber base.

- Content Owners: The content owners / creators are clear winners with a greater demand and price for differentiated content and an ability to monetize existing content library. In a bid to increase the content offering on its platform, Reliance JIO recently acquired strategic stakes in content companies such as Eros International, Balaji Telefilms and Roy Kapoor films

It is unlikely that any of the platforms will make money in the near term as they compete to get more and more subscribers. It is also unlikely that the competition will subside in the near term because for some players like Amazon Prime and Jio, their OTT foray is more about driving footfalls to their core business (E-Commerce and Telecom). They will continue to invest aggressively for a long time without focus on core profitability of the platform.

[1]Over-the-top refers to direct distribution of media to consumers using the internet instead of traditional distribution channels like cable or telecom

[2] TRAI, June 2017

[3]As per Nokia’s Mbit 2018 report, the volume of data consumed in India has grown more than 17x and number of 4G handsets has increased 8x to 218 mnbetween Dec 15 to Dec 17. As per Ericsson’s latest mobility report, total mobile data traffic is expected to further increase 10x in 5 years

[4] Re-imagining India’s M&E Sector, EY-FICCI, March 2018

[5]Re-imagining India’s M&E Sector, EY-FICCI, March 2018

[6]Netflix bought digital rights of Dangal, Padmaavat and Baahubali etc for 200mn+ each.; Amazon has signed an exclusivedeal with Salman Khan for his future releases to digitally release the movies 2 months before the satellite releases

[7] Local body taxes levied by individual states

[8]Re-imagining India’s M&E Sector, EY-FICCI, March 2018

[9] Re-imagining India’s M&E Sector, EY-FICCI, March 2018

[10] Either as part of a bundle or on a standalone basis, either directly or indirectly through a telecom operator or OEM

[11] Company Presentation

[12] Company Presentation

Abhishek Das

Revered Sir/Madam

First and foremost I would like to convey my heartfelt appreciation to you for the highly insightful and enlightening article intituled “OTT Disruption In The Indian Media Sector”, but I would like to add that a few cogent and succinct points apropos average monthly data costs (in addition to the content cost , which you have mentioned and is also available on the respective OTT platforms) , would have been highly beneficial in analyzing the economics of the OTT platforms vis-à-vis the traditional media, especially in an exponentially parsimonious society .