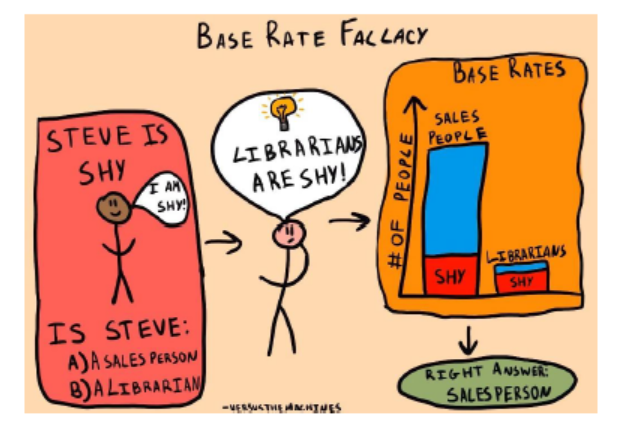

Base rate neglect or base rate fallacy is a cognitive error wherein we ignore the base rate or statistical data in favour of the anecdotal or individual information. We end up making judgements based on our assessment of the anecdotal information which has very little predictive value and we largely ignore the base rate which is far more useful. This leads to flawed reasoning and incorrect conclusions.

For eg. You meet Steve, a person who is quiet, loves reading, and is very organized. When asked if he is more likely to be a librarian or a salesperson, many might say librarian. This judgment ignores the base rate that there are far more salespeople than librarians in this world, making it statistically more likely that Steve is a salesperson, despite the personality description.

Source: versusthemachines.com

Daniel Kahneman in his book Thinking, Fast and Slow described two modes of thinking – System 1 and System 2. System 1 is fast, automatic and does not require any effort. It allows us to take quick decisions based on intuition and experience. System 2 is slow, deliberate and requires considerable mental effort. It helps us solve complex problems which require lot of thought.

Base rate neglect is driven by us using System 1 thinking over System 2 in most cases. We jump to conclusions based on anecdotal information (System 1) and avoid the time-consuming task of incorporating the base rate information (System 2). In many cases, the error is also compounded due to our lack of knowledge of the prior base rates.

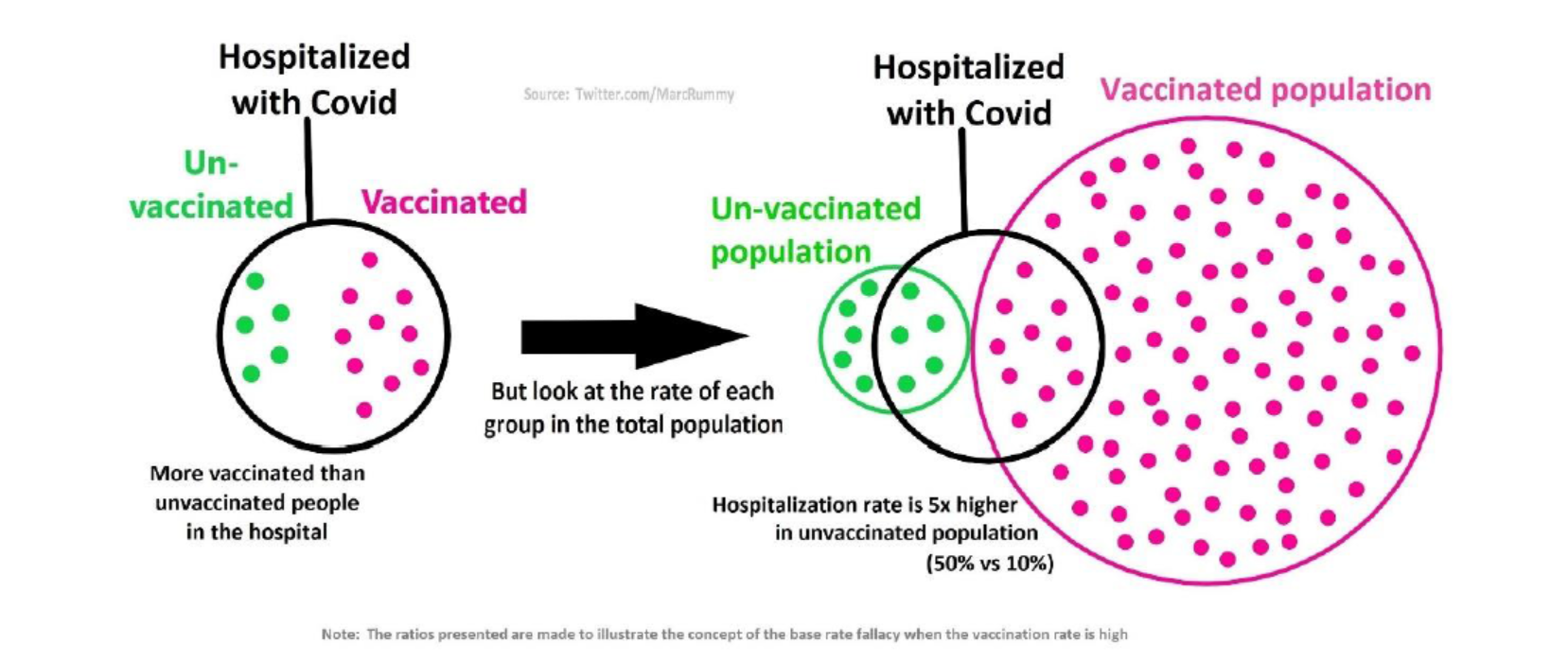

In most instances, base rate neglect leads to errors without any serious consequences. But in some cases, base rate neglect is a matter of life and death. We saw this play out during the Covid-19 pandemic. In 2021 and 2022, a number of media articles across the world reported on the fact that most Covid-19 hospitalizations and deaths comprised those who had received Covid-19 vaccines. The data seemed to suggest that the vaccines were ineffective or even worsened the Covid-19 impact. This information was widely shared on social media and fuelled vaccine scepticism.

This was an erroneous conclusion driven by an ignorance of base rates. As a large % of the population had already received the vaccine, it was normal for vaccinated people to comprise a large % of hospitalizations despite the vaccine being quite effective.

- For eg. In a town of 100k people, 90k are vaccinated and 10k are unvaccinated. 1000 people have been hospitalized in this town due to Covid of whom 600 were vaccinated and 400 were unvaccinated.

- Without considering the vaccination rate in the population, the higher number of vaccinated patients in the hospitals paints a scary picture. One might conclude that vaccinated people are more likely to contract COVID than unvaccinated people. However, when you consider the vaccination rate in the population, it means that 4% (400/10000) of unvaccinated people were hospitalized compared to 0.67% (600/90000) of vaccinated people. This means that the unvaccinated were 6x more likely to be hospitalized than the vaccinated or that vaccines reduced the likelihood of hospitalization by 83%.

Base rate neglect led some people to avoid vaccination, fearing the negative effects despite the vaccines being incredibly effective at reducing hospitalizations and deaths.

Source: https://x.com/MarcRummy/status/1464178903224889345

Absurd Valuations

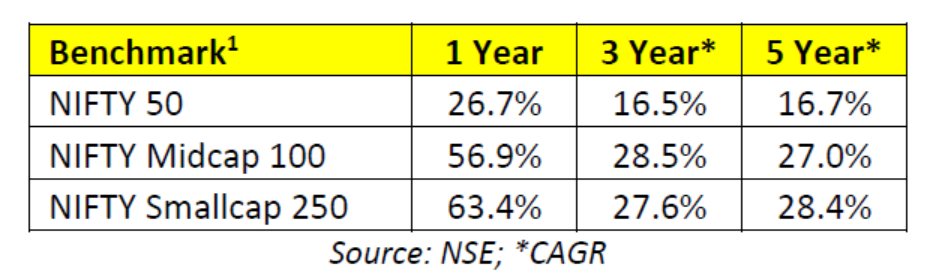

The Indian stock market has been on a remarkable upward trajectory over the last few years.

The rally has been quite broad-based with mid-caps and small-caps doing better than large-caps. While many companies have seen healthy earnings growth, a large part of the rise in stock prices has been driven by an increase in valuation multiples.

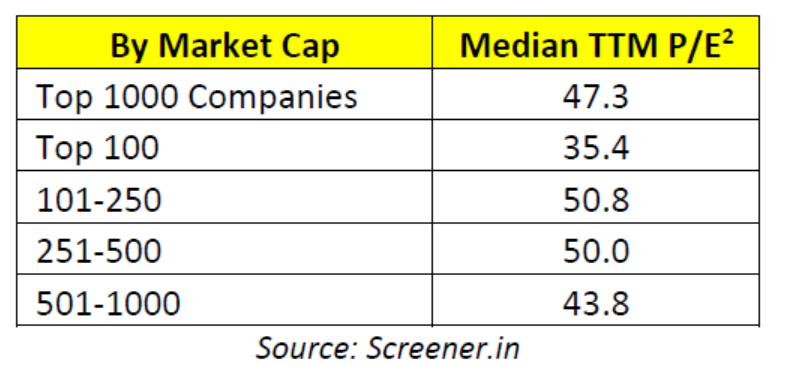

Small and mid-cap valuations, in particular, have reached absurd levels never before seen in India’s capital market history (not even in 2018 or 2008). Of the top 1000 companies by market cap, 217 stocks trade at valuations above 75x TTM P/E and 392 above 50x TTM P/E.

Some investors justify the rich valuations on the basis of the high expected future earnings growth of these companies. Their expectations are driven by narratives of fast economic growth, multi-decadal industry tailwinds and favourable government policies. We believe this optimism suffers from base rate neglect.

The data of historical earnings growth suggests that very few companies are able to deliver high growth rates over a long period of time. The number of companies that are able to grow rapidly from an already high base of profits is even smaller. In other words, the base rate of companies growing at a rapid pace from an already high base over a long period of time is very low. However, the valuations in the Indian market do not seem to account for these base rates.

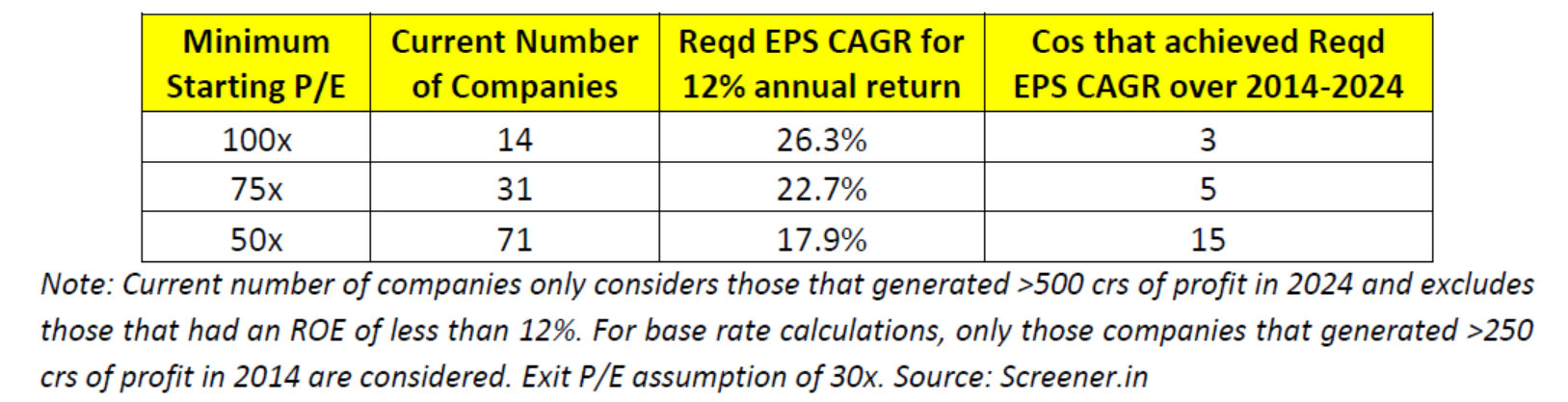

As of now, there are 14 companies that generate > 500 crs annual profit and trade at valuations >100x P/E3. At a starting P/E of 100x and assuming an exit multiple of 30x P/E, these companies would need to grow earnings at a CAGR of 26% to deliver 12% annual returns over the next decade. Given this expectation, it is useful to look at the base rate of such high growth for an already large business.

Only 3 businesses that had a profit > 250 crs4 in 2014 were able to deliver an EPS CAGR > 26% (Bajaj Finance, Eicher Motors, HPCL) over the next 10 years. This shows the low base rate of large companies delivering sustained high growth. If an investor in 2014 had perfect foresight regarding future earnings growth but invested in these 3 companies at > 100x P/E, they would not have made even a 12% annual portfolio return. Those investing at these valuations today are taking the risk of low base rate of high earnings growth while making sub-par returns even if the high growth rate is achieved.

As can be seen from the table below, the base rate challenge is not just limited to ultra-high valuations but even at relatively lower but still rich valuations.

Base rate neglect, where individuals ignore historical base rates in favour of specific, anecdotal evidence, can lead investors to pay excessively high valuations for companies with perceived potential for rapid growth. When investors focus on the exciting prospects of a company, they may overlook the broader statistical realities that most companies fail to achieve sustained high growth. This overemphasis on specific success stories can skew their perception, making them believe that exceptional growth is more common than it statistically is.

Just as we should avoid judging a shy Steve to be a librarian instead of a salesperson, we should avoid paying an excessive price for a business with a strong narrative without considering the base rates.

Source: https://xkcd.com/2476/

_____________________________________________________________________________________________

1 Benchmark returns as of 30th June 2024

2 Loss making companies assumed to have a P/E of 50. Data as of 8th July 2024.

3 Companies that generate less than 12% ROE have been excluded as their current profitability may be depressed and not representative of normalized profit potential

4 Profit adjusted for 7% annual inflation for a like-to-like comparison