The proliferation of internet has enabled a new breed of businesses called Platforms to thrive. Over the last two decades, several platforms have emerged (YouTube, Uber, Airbnb, Google, Facebook, Apple etc) and decimated many traditional businesses. As per a 2017 Credit Suisse report titled “Technology killing Corporate America”, average age of an S&P 500 company has come down to 20 years from 60 years in the 1950s. It is therefore important to understand the investment implications of the era of Platforms.

Platforms vs Linear

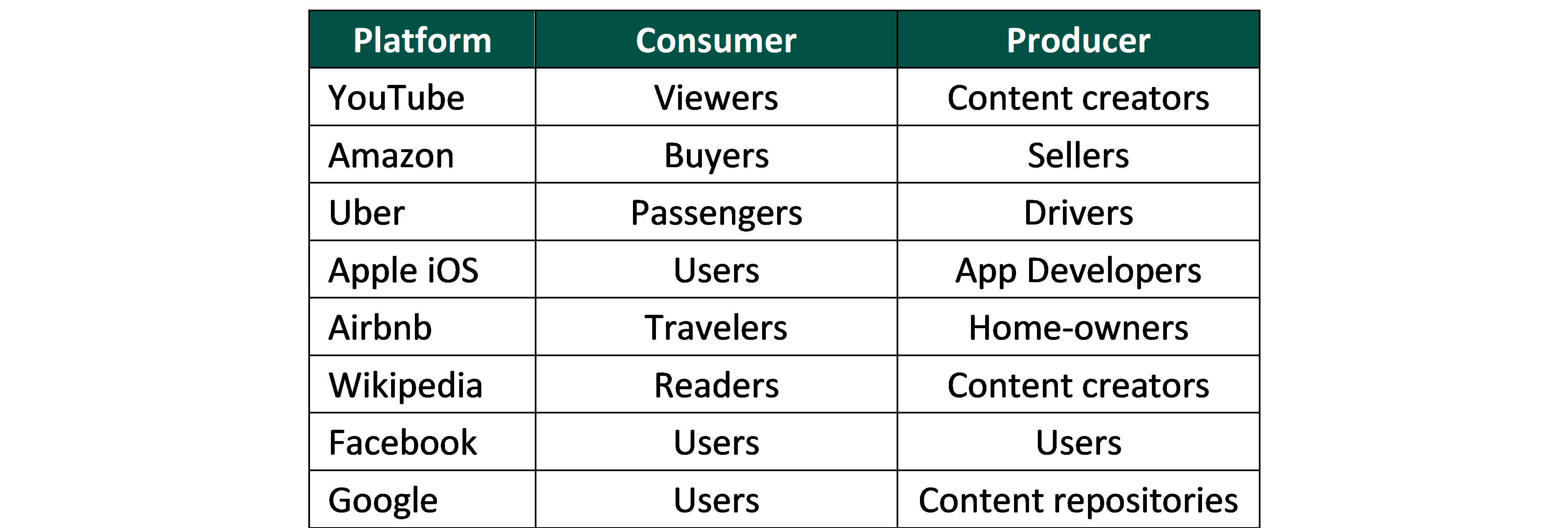

The book ‘Modern Monopolies’ (by Alex Moazed & Nicholas Johnson) defines Platform as “a business model that facilitates the exchange of value between two or more user groups, a consumer and a producer”. By this logic, malls that link consumers and merchants and newspapers that connect subscribers and advertisers are also platforms. In the April 2016 issue of the Harvard Business Review, the article ‘Pipelines, Platforms and the New Rules of Strategy’, differentiates platforms from pipelines. “What’s changed in this century is that information technology has profoundly reduced the need to own physical infrastructure and assets. IT makes building and scaling up platforms vastly simpler and cheaper, allows nearly frictionless participation that strengthens network effects, and enhances the ability to capture, analyze, and exchange huge amounts of data that increase the platform’s value to all”. Offline businesses such as Newspapers and Retail are therefore pipelines and not platforms. Examples of some ubiquitous platforms:

‘Modern Monopolies’ defines a framework that characterizes every platform business. The book says that in linear business models, value flows linearly and in one direction through the company’s supply chain. Linear companies create value in the form of goods and/or services and sell them to someone downstream in the supply chain.

Linear flow of value in a supply chain

Platforms, on the other hand, do not directly create and control inventory via a supply chain the way linear businesses do. They do not own the means of production – instead they create the means of connection. Platforms reduce the frictional cost of a transaction between users. Unlike linear businesses, they do not own or control assets and resources. They facilitate transactions between users who own assets and resources.

In a platform, each additional user enhances the value of the platform for other users. The underlying Network Effects enable platform businesses to expand exponentially turning them into ‘Modern Monopolies’. Take Uber for instance, more customers attract more drivers, which makes the process of booking a cab easier for the consumer. Coupled with these network effects, is the concept of Zero Marginal Cost. As the network grows, the cost of acquiring new consumers and providers is almost zero. The cost of adding one more driver on the Uber network is almost nothing.

Platform businesses therefore often end up being quasi monopolies as once the flywheel is set in motion, not only do they disrupt traditional businesses, but they also end up being one of the only large platforms in that space – Amazon in Horizontal E-Commerce, Uber in Ride-Hailing Services, Airbnb in Vacation Rentals or Google in Search.

How relevant are ‘Moats’ in the era of Platforms?

It is clear that platforms are extremely powerful business models and are quasi-monopoly in nature. What this means is that any business that operates in a space that has competition from Platforms is at risk of losing some or all of its relevance. Does traditional moat investing still work?

In his seminal piece ‘Competition Demystified’, Bruce Greenwald said that there are really only three sources of competitive advantages (or ‘moats’) for a company:

- Supply:These are strictly cost advantages that allow a company to produce and deliver its products or services more cheaply than its competitors – either due to privileged access to inputs or proprietary technology that is protected by patents or by experience/know-how or some combination of these.

- Demand:Some companies have access to market demand that their competitors cannot match. These demand advantages arise because of brand, customer captivity that is based on habit, on the costs of switching, or on the difficulties and expenses of searching for a substitute provider.

- Economies of scale:If costs per unit decline as volume increases, because fixed costs make up a large share of total costs, then even with the same basic technology, an incumbent firm operating at large scale will enjoy lower costs than its competitors.

Swathes of sectors / companies that had one or more of these ‘moats’ have seen value migration to platforms over the last decade. Below are few examples:

- Retail: Despite decades old brand strength and economies of scale, large retailers lost out to platforms over the last decade. The sector has seen several high-profile casualties in the last 5 years as platforms like Amazon became very large – Sears, Toys R Us, KMart, JC Penney etc. In India, Amazon and Flipkart together (with USD 8 bn+ GMV) are bigger in size than the top 10 Indian retailers combined – Future Group, Reliance Retail, ABFRL, Avenue Supermarts etc.

- Brands (FMCG, Fashion & Lifestyle): Large brands maintained their market share because of customer captivity that was based on trust, habit, or the costs of switching, or on the difficulties and expenses of searching for a substitute provider. These moats have now become weaker due to the democratization of distribution by platforms. Further, platforms also aid in information democratization — consumer reviews on platforms ensure that even smaller brands with a genuine value proposition can garner the trust of the consumers and grow. The relevant example to illustrate this point is Dollar Shave Club (DSC) which started in 2011 and took a significant market share from the industry leader Gillette (owned by P&G). The case study illustrating DSC’s journey is available in this article on Stratechery. P&G’s first advantage, their willingness to spend money on research and development, was neutralized because razors were already good enough. DSC was able to further neutralize the strength of P&G’s brand and advertising by leveraging media platforms like YouTube and Facebook through which it communicated its value proposition to its consumers.

- Media: A large chunk of advertising revenues are shifting from traditional media to digital platforms such as Google, Facebook, YouTube and Linkedin. Digital platforms already account for ~50% of all advertising. This is disrupting business models of traditional media such as Cable, Radio and Print. Also due to the OTT proliferation, incumbents like Broadcasters, Cable/DTH and Exhibitors are losing relevance to content platforms like YouTube, Amazon Prime Video and Spotify. Last year, we had spoken in detail about the OTT disruption in the Indian Media Sector in our Q4FY18 Investor Update.

- Hospitality: Online Travel Agencies (OTAs) such as Expedia, Booking.com, MakeMyTrip have enabled newer distribution channels for smaller chains and independent hotels. Similarly, platforms like Airbnb have resulted in hotel chains losing market share to standalone hotels or homestays. These platforms can serve customers who are brand agnostic as long as their needs are met at attractive prices.

- Banks/NBFCs:

- Currency transfer platforms like Transferwise (they match transfers with other people) claim to be almost 90% cheaper than banks. It already has 15%+ market share of the UK transfers market.

- P2P platforms like Lending Club and Upstart, although still small in size, are disrupting consumer lending which was hitherto monopolized by banks. In India, similar platforms like Faircent, Lendbox etc. are active though still very small.

- Smartphones: Apple was able to take ~24% market share of the global smartphone market from 0% in 2007. Players like Nokia and Blackberry had competitive moats such as: trusted brands, huge R&D budgets, and massive scale. But they did not have any platform advantage. Apple’s iOS platform connected app developers on one side and app users on the other—generating value for both groups. As the number of participants on each side grew, that value increased by way of network effects. The company’s App Store offers 2+ million apps and has cumulatively generated billions of dollar worth of value for developers.

Are Platforms the only relevant business model today?

While we have discussed in detail the threat to traditional businesses from platforms, most B2B businesses cannot be platformized. When the number of buyers and/or sellers are small in number, the cost of a transaction is already small enough that it cannot be further optimized by the presence of a platform. This is true for most B2B businesses. Entire swathe of large sectors such as Manufacturing, Pharmaceuticals, Infrastructure etc. are largely immune to platform disruption. Having said that, there are still exceptions. When there are large fragmented sources of supply and demand in B2B businesses, there can be successful B2B platforms – Alibaba in China and Indiamart in India are relevant examples.

Even several B2C businesses have so far been immune from disruption by platforms. Media is one example of a B2C space that has all ingredients for platformization but was instead disrupted by OTT platforms that are NOT really platforms. The largest, fastest growing and the most successful content players are not platforms. Netflix despite being a technology company is not a platform. Neither is Amazon Prime Video. Netflix has as linear a business model as any other traditional company. The streaming company licenses or produces all the content it creates. Netflix has spent billions of dollars on acquiring content of its own and distributes it directly to the consumers. Unlike a platform business, the marginal cost of adding content on the platform is substantial. Whether Netflix can sustain this asset heavy business model is another question. Flipkart in India was not really a platform until the change in FDI rules recently. A large proportion of its sales was through its own company WS Retail.

The same factors that make platforms successful also make them vulnerable. As Facebook grew its users initially, the value of the platform increased. However, as too many ‘friends’ joined, users were no longer comfortable sharing personal content. The network effect curve had hit an inflection point. MySpace shut down because the quality of new users joining was compromising the experience of the existing users in the network. Twitter is facing a similar issue with increased trolling leading to user dissatisfaction. For platforms to survive, they need to continue to maintain and strengthen the value proposition to their network.

Investment Implications

As an investor, how should one invest in an era of platforms? Should or can one compete with platforms? As we have seen in several examples earlier, moats that several linear businesses had can be quickly destroyed by platforms. An investor should be cognizant of investing in businesses that are facing or could face competition from such businesses. Some examples:

- Investing in Pipeline businesses – Pipeline businesses connect two sets of users but in an offline mode, and are the most prone to disruption – Retail vs E-Commerce, Content distributors (Cable/DTH/Exhibitors) vs OTT. Most pipelines have responded by launching their own platforms but with little success – Futurebazaar / Fabfurnish (Future Group), Ajio (Reliance), Nnow (Arvind) etc. Some have already shut down.

- Investing in platforms seeing competition from other platforms: Platform businesses tend to move aggressively into new terrain and into what were once considered separate industries. They leverage their existing and much larger user base/data to capture a disproportionate share from the incumbent platform. Google has moved from web search into local classifieds (competing with Just Dial, Yelp), mapping (competing with Foursquare), and hotel/airline booking (competing with MakeMyTrip, Booking.com). As investors, we must evaluate whether a larger platform with access to a much larger user base and capital, can negate the value proposition of a smaller incumbent platform. This is also important because platform businesses often tend to be winner-take-all.

- Investing in Brands:

- Young and niche brands, with a clear value proposition are able to leverage e-commerce platforms (Amazon etc) for distribution, and media platforms (YouTube/Instagram) for branding/marketing to grow their business. Dollar Shave Club discussed earlier is a relevant example.

- Strong incumbent brands that command pricing premium (but without a clear value proposition) are being disrupted by smaller brands that have used platforms to overcome barriers such as distribution and advertising/marketing. Large restaurant chains that thrived due to their brand and distribution are facing stiff competition from local restaurants that have increased their visibility due to likes of Grubhub, Zomato, Swiggy etc. These platforms have eased distribution, removed information asymmetry, and enabled seamless marketing. This is expected to impact large chains such as Dominos, McDonalds etc.

- Investing in Businesses that leverage platforms: There are certain businesses that use platforms to further their business:

- Publishers / Content owners like Universal Music, Sony Music, Saregama have seen their businesses thrive because of IP monetisation on platforms such as Spotify, Apple Music, Amazon Music etc.

We have seen the power of Platforms and their ability to even disrupt incumbents with strong moats. Every business has to constantly innovate to create new sources of competitive advantage. As investors, we are better off avoiding businesses that compete with platforms, or businesses that lose their brand power due to democratization of distribution, information, and branding/marketing by platforms. On the other hand, challenger brands that are leveraging platforms to their benefit can be attractive investments.