The government surprised the markets last month by cutting corporate tax rates to 25.6% from 34.9% (all inclusive) earlier. All else equal, the future profits of a company currently operating on a full tax rate should increase by ~15% and therefore the intrinsic value should also go up. However, the reality is a bit complicated. We share below our thoughts on the impact of tax cuts on different companies.

Non-Event for Most Players

Companies that lack pricing power are unlikely to benefit a lot from the tax cuts. In most industries, competitive forces will ensure that all the gains from the tax cuts are transferred to the customer through price cuts over time. Just like a big decline in raw material costs doesn’t result in a sustainable improvement in profitability, gains from the tax cuts will also be competed away. Only companies with pricing power can retain the higher profits due to lower taxes. The reality however is that there are very few listed companies in India that have any meaningful pricing power.

A company has pricing power if it can raise the price of its product/service without a significant impact on its sales. These are typically dominant companies with a strong customer lock-in (could be due to strong brands, high switching costs, network effects or proprietary IP). Pricing power is not a function of the number of players in the industry but the nature of the product/service. There are certain industries like aviation where even the market leader (Interglobe Aviation) may not have much pricing power despite having a 45%+ market share. All players in aviation must match their fares to the competitor fares.

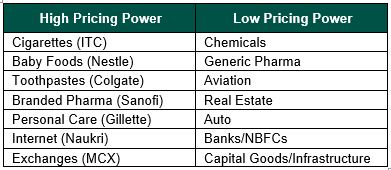

The below table gives a snapshot of companies / industries in both categories:

It is often not as binary a classification as shown in the table above. There might be certain companies which have some pricing power even in sectors which have very little pricing power and vice versa. For instance, Godrej Properties in Real Estate, SBI in Savings Deposits, Maruti in Auto etc. The above classification is only used for an ease of analysis.

Companies with Pricing Power benefit the most

Companies that have pricing power can retain bulk of the benefits from tax cuts as the price elasticity of demand of their product/ service is low. This category of companies will see a two-fold benefit of tax-cuts – 1) Future profits can increase by ~15% due to the decline in taxes; 2) There is a permanent increase in the ROE of these companies as the same capital employed now generates higher profits. Both these factors result in higher future free cash flow (FCF) generation for the same level of growth resulting in an increase in intrinsic value of the company.

- How does Growth and ROE impact the Intrinsic Value?

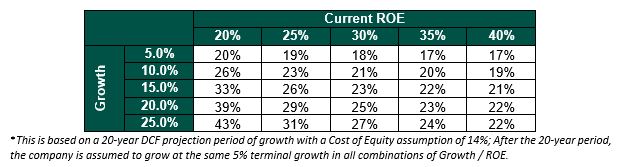

For companies that can retain the tax cut benefits entirely, the increase in intrinsic value depends on the ROE and growth profile of the company. A high growth company benefits from deploying the tax savings towards growth opportunities thereby creating a compounding effect on earnings and cash flows which is missing in low growth companies. Therefore, higher the growth, higher is the increase in intrinsic value as shown in the table below.

Increase in Intrinsic Value for Companies with Pricing Power*

The impact of ROE however is slightly less straightforward. It is a widely held belief that companies that have higher ROEs will benefit disproportionately (vis-à-vis companies that have a lower ROE) because the increased profits can be reinvested at higher ROEs to generate even higher profits and so on and so forth, thereby creating a virtuous cycle. However, this is an unlikely scenario. Companies that have very high ROEs (typically strong consumer franchisees) are cash rich with growth opportunities lower than their internal cash accruals. Their growth is not constrained because of a lack of capital. Rather, they are paying out large dividends because of an inability to reinvest their profits in the business. Therefore, the benefits from a tax cut for these companies will be limited to an increase in dividends and not an increase in growth.

In fact, counter-intuitive as it may sound, a company with a lower ROE (but with an ability to retain the tax cut benefits) should see a higher % increase in intrinsic value than that with a higher ROE (as shown in the DCF sensitivity table above). For the same growth, a HUL which is already at 80%+ ROE benefits less in % increase in intrinsic value than say a Marico with 30%+ ROE (assuming both have similar growth). This is because the present value of the tax cut benefits is the same for both companies. However, it is a larger % of the intrinsic value for a lower ROE business than it is for a higher ROE business.

The above may not be true for industries with players that do not have pricing power as shown in the next section, as the efficient player will take price cuts to capture volume growth thereby nullifying the increase in profits for the inefficient players.

The Strong become Stronger, the Weak become Weaker

Because most of the companies in India operate in ultra-competitive sectors and have no pricing power, these companies will have no option but to pass on bulk of the tax-cut benefits to the consumers. Therefore, there may not be any benefits to most of these companies other than perhaps an increase in volumes over the long term (due to lower prices). However, there are still a few companies that benefit due to the tax cuts despite having no pricing power. This is because the tax cuts benefit the most efficient players more than the weaker players (even if both pay the highest tax rate). In fact, over the long term, the inefficient player might see an erosion in profitability because of the tax cut. Here’s how.

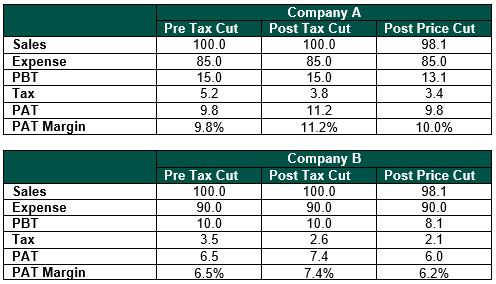

Company A and Company B operate in the same industry and pay the same tax rate of 35%. Company A is more efficient than B with higher profitability. On a sale of 100 Rs, Company A and Company B make a PAT margin of 9.8% and 6.5% respectively. Post the tax cut, Company A‘s PAT increases from 9.8 to 11.2. Company A can now reduce its selling price by 1.9 and still generate the same profits as earlier. Company B will be forced to match this price cut. This will result in Company B’s PAT falling from 6.5 to 6.0. Due to its lower profitability, Company B will see a decline in profits if Company A decides to pass on the tax cut benefits. The tax cut is therefore bad news for the weaker players in all industries.

Indian Companies benefit in areas which have Foreign Competition

Companies that face a lot of foreign competition will benefit from the tax cuts. The tax reduction will make Indian players more competitive vs foreign players. The benefit will be particularly high for companies that only have foreign competition and little competition from other Indian companies. They can either retain this benefit or gain market share from foreign competitors through price cuts. For specialty chemical companies that are the only Indian exporters of the chemicals that they manufacture, there might be a permanent benefit on margins and ROEs from the tax cuts. However, for IT companies that also face a lot of Indian competition in foreign markets, the impact may be much lower.

Formalization of the Economy as Unorganized becomes less Competitive

Companies that have a large degree of unorganized competition may gain significant market share as the tax arbitrage between organized and unorganized sectors reduce. The organized players may not retain the excess margins/ROE but they may see volume gains from the unorganized sectors. The lower tax rates should lead to further formalization of the economy as unorganized players lose a part of their edge stemming from tax evasion. For instance, retailers like D-Mart in the highly competitive grocery retail benefit as their competitiveness vis-à-vis unorganized players increase.

Summarizing, the tax cut is a positive for corporate India but not everyone benefits. Surprisingly, there will be some losers as well. In most industries that are competitive, the benefits of the tax cuts are passed on to the consumers in the form of lower prices. The biggest beneficiaries of the tax cuts are companies that have pricing power. Among them, those companies that have reinvestment growth opportunities benefit the most.