“Whatever men attempt, they seem driven to try to overdo. When hopes are soaring, I always repeat to myself ‘Two and two still make four and no-one ever invented a way of getting something for nothing’. When the outlook is steeped in pessimism, I remind myself, “Two and two still make four and you can’t keep mankind down for long.”

– Bernard M. Baruch

These are uncertain times. We don’t know how long the coronavirus pandemic will last. We don’t know how many people it will infect or kill. We don’t know how long the lockdowns will remain. We don’t know when things will return to normal after the lockdowns are lifted. We don’t know how many jobs will be lost or how many businesses will be shut. We don’t know if it will be a V, U or an L shaped recovery. We do not know if the markets have bottomed out or if they will fall a lot more.

There is clearly a lot that we don’t know. How do we go about taking investing decisions with so little knowledge about the future?

The answer is simple. We take investment decisions where the dependence on these unknown variables is low. We invest with a focus on the long-term rather than the short-term. It is important to remember that the intrinsic value of a business has very little dependence on the cash flows that it generates (or loses) over the next 6-12 months but is substantially dependent on those that it generates over the next 10-20 years. If the long-term thesis still holds, even a painful short term doesn’t reduce the intrinsic value of a business by more than 10%. Focussing on the long term has always been an important feature of the 2Point2 investment philosophy.

We seek to invest in good businesses with a favourable long-term outlook run by capable and ethical management teams that are available at a discount to intrinsic value. Over the last 4 years, many of our investments have seen short term impact of external factors like demonetization, GST implementation and IL&FS crisis. While these events have led to bad quarterly/annual numbers, most of these companies were able to recover and continue their long-term growth journey. Our major investment mistakes have generally been more to do because of deterioration in the long-term fundamentals of a business or management missteps rather than the impact of surprise external events.

Our view is the Covid-19 crisis will be no different. It will have a deeply negative impact on the short-term performance of most businesses but not materially alter their long-term trajectory. However, to do well over the long-term, businesses first need to survive in the short-term. For good businesses with strong balance sheets, this is unlikely to be an issue. For leveraged or weak businesses, the short-term pain may also seriously impact their ability to perform well over the long-term.

In the below sections, we discuss the potential impact of the crisis on our portfolio. We also discuss our portfolio strategy in these uncertain times.

(*Only those investments where we have a greater than 4% allocation are discussed. The rest of the investments constitute only ~3% of aggregate portfolio)

Covid-19 Impact on Portfolio

Non-Financials

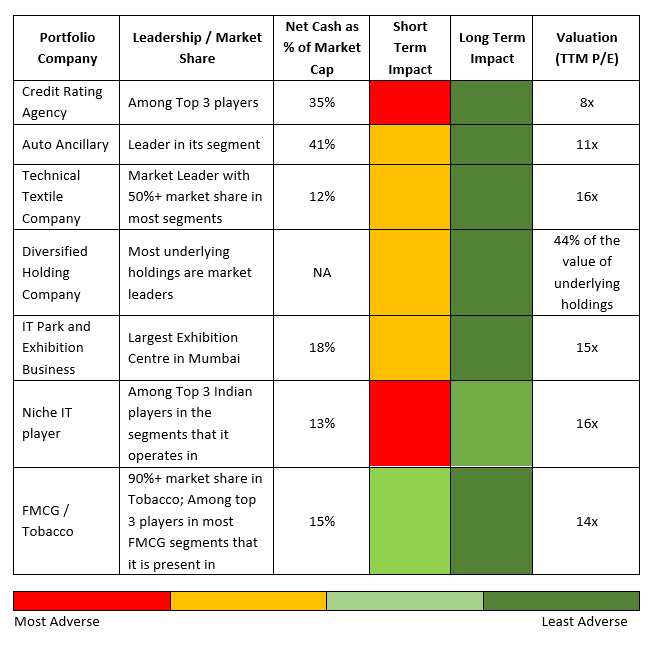

ALL of our non-financial investments are in companies with ‘Net Cash’ on the balance sheet which will allow them to easily tide over short to medium term demand shocks. We may not have a visibility on when the economy recovers, but we are certain that all these companies are capable of withstanding a prolonged slowdown by absorbing losses over the short to medium term.

Further, these companies are market leaders with a strong competitive positioning and have industry leading return on capital metrics. This will allow them to gain market share over the medium to long term as weaker players find it difficult to compete. There is an added margin of safety because of the reasonable valuations that these companies are trading at.

The below table summarizes key characteristics of our portfolio companies – leadership, balance sheet strength, impact of current crisis and current valuation:

Financials

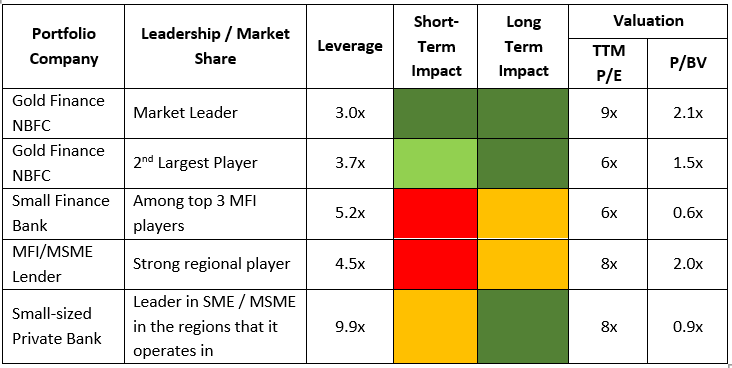

Financials is a large allocation in our portfolio with a ~42% weight (compared to a 36.5% weight in the Nifty 50). While all stocks in our portfolio have been hit, the financials portfolio has been particularly worse off (Bank Nifty has fallen by 40.5% in this quarter). There is a general expectation of poor asset quality in both retail and corporate assets because of the Covid-19 economic shock. However, we don’t think all lenders will fare poorly in this environment.

Gold Finance forms ~50% of our financials portfolio where the Covid-19 impact will be minimal. As gold loans only have a 60-65% loan-to-value ratio, these businesses will not incur any credit costs because of the lockdown. Instead these companies are likely to see a higher demand as other lenders are forced to reduce loan disbursals. A positive ALM also ensures that there is no liquidity issue. In the financials space, we don’t think there is any business safer than gold finance in the current environment. The risk in this category has more to do with regulations and gold price rather than Covid-19.

The small finance bank (SFB) that we own will see impact on cash collections from its MFI customers because of the lockdown. The quantum of the credit cost depends on how long the lockdown continues. Based on experience of the AP crisis in 2010 and Demonetisation in 2016, the credit cost should be manageable for a well-diversified SFB but a prolonged lockdown can have an adverse impact on the Balance Sheet. On the other hand, the NBFC MFI that we own (in some portfolios) will face similar issues but might find it more difficult to tide over this crisis as compared to a bank.

The rest of the Financials portfolio may see an increase in credit cost over the short term but should be fine over the long term as large part of the loans are secured against adequate collateral.

The below table summarizes key characteristics of our BFSI portfolio – leadership, balance sheet strength, impact of current crisis and current valuation:

Our expectation is that majority of the financials portfolio will remain largely unscathed even in the short-term and may even benefit from lesser competitive intensity in the long-term. We need to actively monitor our MFI investments which still carry high downside risk due to the risk of high credit losses.

Portfolio Actions

While the portfolio has been badly hit, the actions we take now will have a large bearing on our future returns. There are 3 broad actions that we are taking at a portfolio level –

- Deploy Cash (if available)

We have used the fall in the stock prices to add new positions in the portfolio and increase allocation in some existing positions. We have so far deployed ~50% of the cash available in our portfolios (on aggregate basis) at the start of March 2020. Some of these companies didn’t form a part of our portfolio earlier due to their rich valuations. After a 30-50% fall in the stock price, valuations have become attractive for more companies on our investment watchlist.

“The most common cause of low prices is pessimism – sometime pervasive, sometimes specific to a company or industry. We want to do business in such an environment, not because we like pessimism but because we like the prices it produces. It’s optimism that is the enemy of the rational buyer.”

– Warren Buffett

This does not mean that we are predicting the bottom for the market or for individual companies. The high volatility in an uncertain environment may result in stocks falling far below their intrinsic value. Since we cannot predict the short-term price movements, it is better for us to focus on rational decisions from a long-term perspective. We are fine with incurring mark-to-market losses in the short-term if we are confident that the risk-reward for the long-term is favourable. We would not like to risk potentially losing a high upside in the long-term by worrying about the downside in the short-term.

- Switches

In some cases, we have partially shifted from existing portfolio companies that we like to companies that we like even more (and which are now attractively priced). This is not because the existing investments are bad but because we believe there are others which offer an even better risk-reward. We have not had the opportunity to make such switches earlier because in the previous market declines (demonetization, post-IL&FS), the best businesses were not impacted a lot and these stocks remained expensive. This crash has been more democratic and has impacted all stocks whether good, bad or ugly. Even HDFC Bank fell by 43.4% from its peak, something it has never done barring the 2008 Global Financial Crisis.

Our belief is that this shift from good companies to attractively valued better businesses improves the risk-reward of the portfolio. It is also likely that if the Covid-19 crisis is a prolonged one, the better businesses will be less impacted and do relatively well. If the volatile environment persists, there could potentially be more such switches in the portfolio.

- Exits

We have made one complete exit due to the Covid-19 impact – an aviation stock which was a small allocation in the portfolio. Covid-19 is a major negative event for all airlines. While for other industries the disruption will be limited to the period of lockdowns, airline travel will probably take far longer to recover due to “social distancing” norms and a longer-term decrease in non-essential business travel. While some of the weaker airlines may not survive without government support, we expect even the stronger ones to incur losses large enough to impact their cash reserves. We therefore decided to completely exit this position.

Our MFI investments may also be most at-risk if the lockdowns persist for longer. We will monitor collection trends over the next couple of months to determine next steps.

While this might appear to be a different world from just two months back, our investment strategy and process continues to be the same. Timeless investment principles don’t change because of a crisis.