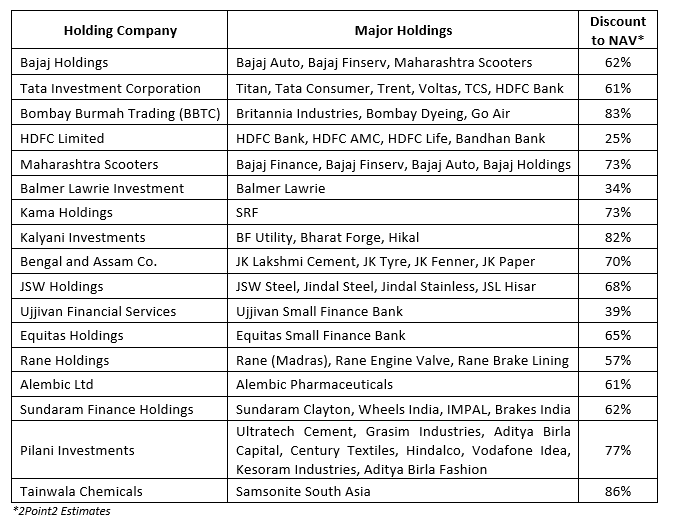

India has a large number of listed Holding Companies (HoldCos) that hold shares of other listed and unlisted companies. A large part of the value of these HoldCos stems from their stakes in other businesses. Globally, HoldCos trade at a discount to the underlying Net Asset Value (NAV) of their holdings. These discounts tend to range between 5-20%. HoldCos in India are unique because the HoldCo discount is sometimes exceptionally high, ranging from 50-80%.

The quantum of the HoldCo discount varies significantly across companies and depends on multiple factors. These factors are not necessarily independent and often impact each other. We will discuss below some of the factors that seem to have a bearing on the HoldCo discount. Finally, we will discuss the framework that we use at 2Point2 to invest in HoldCos.

Factors Impacting HoldCo Discount

- Cascading impact of Dividend Distribution Tax (DDT): Until FY20, a HoldCo (holding less than 50% stake in a company) when it received dividends from the underlying holdings, had to pay DDT again upon remitting the same dividends to its shareholders. The shareholders of a HoldCo paid double the DDT – once at the holding level and again at the HoldCo level.

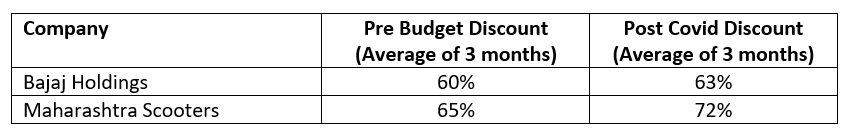

An investor who invested in Bajaj Holdings to get exposure to the underlying stocks (Bajaj Auto, Bajaj Finserv) was getting ~17% lesser dividends than if he owned the stocks directly. In the Dividend Discount Model of valuation, the value of a company is the present value of all the future dividends. Therefore, this 17% dividend leakage merited at least a 17% HoldCo discount. The discount however is significantly higher at 62%.

Recent change in dividend taxation has eliminated this leakage. In the new tax regime, the HoldCo will get full credit for the dividends received from its underlying holdings if it pays out the same to its shareholders. In this scenario, it will not have to pay corporate tax on the dividends received. This is irrespective of the extent of shareholding in the company. In the earlier regime, one could avoid double taxation only if it held 50%+ stake in the company.

Because of the elimination of the 17% dividend leakage, the HoldCo discount should have reduced (especially for HoldCos which earlier had high DDT payouts like Bajaj Holdings and Maharashtra Scooters). Instead, the opposite happened after the Covid-19 market crash.

- Leakage due to Capital Gains: If there is a sale of the underlying holdings, the HoldCo would need to pay capital gains tax on the gains and the shareholder has to pay tax on the dividend income (as high as 43% in the highest tax bracket). For a HoldCo that has large strategic holdings, this discount may not be relevant as a sale would likely be done in a tax efficient manner by transferring shares of the holdings directly to the shareholders (For eg. Thomas Cook India transferring shares of Quess Corp directly to its shareholders). This would likely be the case for a Bombay Burmah or Bajaj Holdings which primarily have strategic holdings.

On the other hand, Tata Investment Corporation operates almost like a mutual fund and has large non-strategic holdings. It buys and sells these stocks every year incurring capital gains in the process. When these gains are paid out as dividends or through buyback, it leads to additional tax leakage. The removal of DDT has increased the tax leakage in such instances for shareholders in the higher tax brackets.

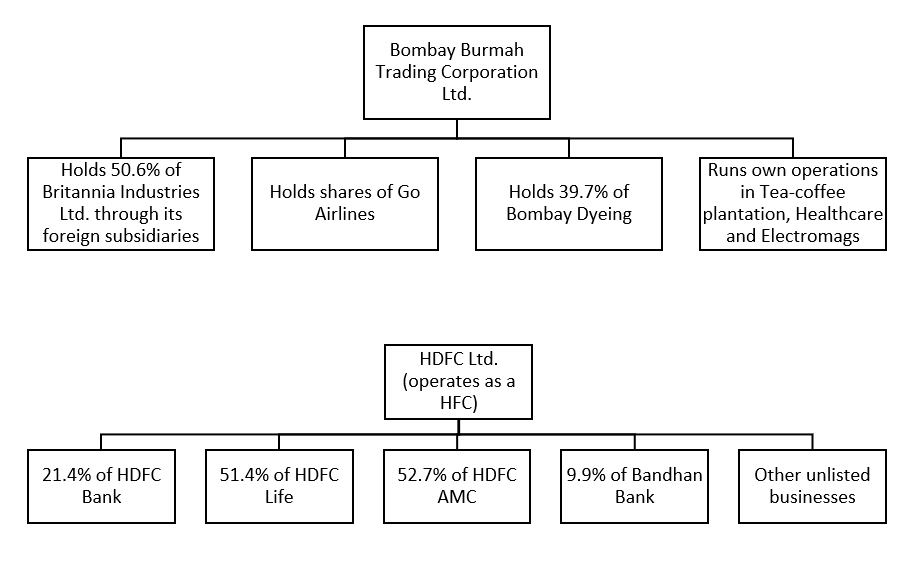

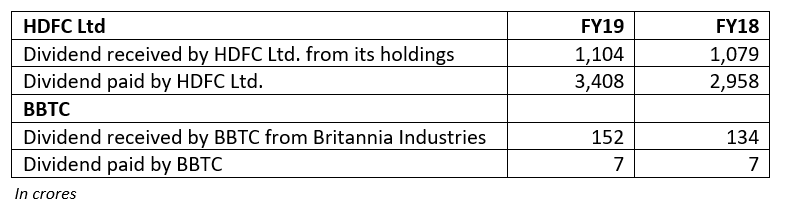

- Poor Capital Allocation: The HoldCo is often not just a shell company. It either has a business of its own (Operating HoldCo), or it has investments in other businesses which require periodic infusions of capital. In either of the cases, investors of the HoldCo do not get full access to the dividends/capital gains received from the underlying holdings. The cashflows may either be used in the operating business or may be used to make investments in other poor businesses (through equity or unsecured loans). Let us evaluate two companies BBTC and HDFC Ltd to understand this point.

While HDFC has investments in many good businesses and is itself a large NBFC, BBTC has investments in many poor and/or loss-making businesses such as Aviation, Plantation, Real Estate etc. The below table summarizes the dividends received from underlying holdings and subsequently paid out to shareholders in the case of both the companies for FY19 and FY18.

The investors in BBTC do not get access to the cashflows of Britannia. The dividends/capital gains of the ‘good’ business are used to fund other ‘poor’ businesses like Aviation, Plantation, Real Estate business which are assigned an implied negative value by shareholders. BBTC therefore trades at a whopping discount of 83%. On the other hand, HDFC Ltd is a profitable and leading NBFC. All of its investments are in profitable market leaders. It not only remits all dividends of underlying companies but also adds to the dividend pool. Therefore, the HoldCo discount for HDFC Ltd is estimated to be only 25% which is one of the lowest among all other HoldCo companies.

- Indirect control: The shareholders of a HoldCo do not directly exert control over the underlying holdings. This may not matter if the incentives of the shareholders of the HoldCo are aligned with the incentives of the shareholders of the underlying holdings. For instance, the interest of the shareholders of Ujjivan Financial (which owns 83% of Ujjivan SFB) is aligned with the shareholders of the SFB as there is no other business in the HoldCo. The voting on any corporate action (merger, demerger, acquisition, dividend etc) will not be counterproductive to the interest of the HoldCo shareholders. HoldCos where incentives of shareholders are not aligned with majority owners of HoldCo or minority owners of underlying holdings deserve a higher discount.

- The whole is lesser than the sum of the parts: The shareholders of the HoldCo get exposure to a set of companies in different sectors. Each of those businesses individually may trade at higher valuations as they each find shareholders who find the company and the sector valuable. The HoldCo however trades at a discount to the sum of the parts as there are only very few investors who consider all businesses to be attractive enough to invest in them at current valuations. They therefore apply a discount to one or more of those businesses. For instance, a value investor who is bullish on the 2W space likes Bajaj Auto and may be willing to pay 16x P/E to invest in it but he may not like investing in Bajaj Finance at 5.4x P/BV. Therefore, he would want to buy Bajaj Holdings at a discount.

- Leakage due to Expenses at Holdco: Some HoldCos also bear additional administrative and compliance costs even though there are no operating revenues of their own. This is often a small amount and does not affect the HoldCo discount by a lot. For instance, the total annual expense of Balmer Lawrie (the HoldCo) is less than 1.5% of the dividend received from its holdings.

2Point2 Framework for investing in HoldCos

Our view is that, while there are reasons that justify some Holdco discount, the large size of the discount for many HoldCos seems to have little logic and is arbitrary in nature. For HoldCos with good governance and capital allocation track record, HoldCo discounts above 20% are not fundamentally justified. This arbitrary discount provides opportunities for long-term investors to exploit and generate better returns with lower risk.

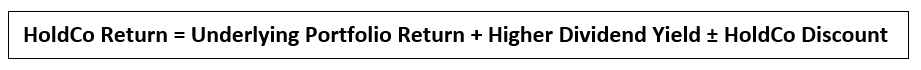

The return from investment in a HoldCo is driven by three components.

When we invest in a HoldCo, we prefer that all three components contribute positively to our return.

- Discount is secondary, quality of holdings is primary: The underlying portfolio return is likely to be the biggest driver of returns for the HoldCo. If we do not like the underlying holdings, the size of the HoldCo discount is irrelevant. Sometimes while we may like the holdings, we may not completely like the valuations. However, we are willing to live with a lower return from the underlying holdings if the other two components can compensate for it.

- Prefer high dividend yield stocks: We prefer HoldCos that pay out the dividends received from their holdings to their shareholders and have high dividend yields. A company with a HoldCo discount magnifies the underlying dividend yield by (1/(1 – HoldCo discount)) times (assuming all dividends that are received are paid).

For instance, the dividend yield of the underlying holdings of Tata Investment Corporation is 1.09% but for shareholders of Tata Investment it is 2.62% because of the 61% HoldCo discount. An investor who owns Tata Investment gets a 1.53% higher return per annum due to the dividend yield differential than by directly owning the underlying stocks. The compounding benefit of a 1.53% higher return is enormous over the long term. In the new tax regime, this is even more attractive because of the elimination of DDT leakage and expected rise in dividend yields.

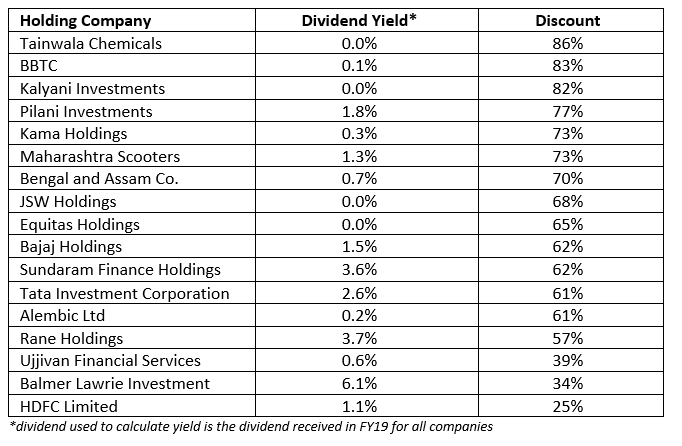

The high dividend yield also acts as a force that prevents the discount from expanding. If the HoldCo discount were to expand, the dividend yield differential would increase making it even more attractive for shareholders of the underlying holdings to shift to the HoldCo. As can be seen from the table below, companies that have high dividend yields do have a lower discount than those that don’t.

It is likely that the elimination of DDT will force many HoldCos to start paying out dividends received by them to avoid paying the 25% corporate tax on the dividends received. This could result in the discount narrowing for these HoldCos.

- Prefer to invest at peak discount: We track the discounts of HoldCos over many years. The discount moves between a wide range. We prefer to invest when the discount is at its peak or higher than normal, to benefit from the discount narrowing over time. This also ensures that the dividend yield differential is higher than normal.

- Prefer companies where the incentives of the minority shareholder are aligned with the promoters: In a HoldCo like BBTC, the promoters want to use the dividends from the core holding Britannia to fund other businesses in aviation, plantation, realty etc. This is at odds with the minority shareholders who are more interested in getting direct access to the cashflows of Britannia. We would only prefer to invest in HoldCos with strong governance, good capital allocation track record and alignment of incentives.

- Prefer non-operating HoldCos: We prefer HoldCos that have limited or no operations of their own. As a result, they end up passing all dividends to the shareholders, unless of course the operating business itself is attractive like in the case of HDFC Ltd or Bajaj Finserv.

Disclosure: One or more of the HoldCos discussed above are part of 2Point2 Capital’s portfolios.