Since we started the PMS in 2016, one of the largest sectoral allocations in the 2Point2 Long Term Value Fund has been in the Gold Loan space. Despite having sold a good chunk in some of the names (due to increasing concentration), it continues to be a fairly large allocation.

Naturally, we end up getting tons of questions related to these businesses. Below we share our answers to some of the most frequently asked questions. This should also help to articulate our investment thesis and why we continue to invest in this space.

Q: So, what’s so special about the Gold Loan (GL) players?

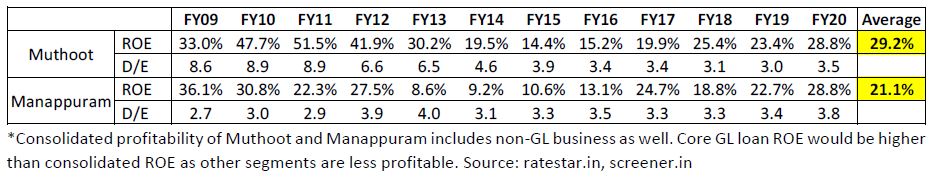

A: Lots actually. For instance, the two GL specialist players (Muthoot and Manappuram) are among the most profitable listed lenders in India.

They have averaged an ROE of 20-30% over the last decade. The current ROE is in excess of 28% despite leverage of less than 4x. Only Gruh Finance (no longer listed), has a better long-term ROE track record than Muthoot (but with much higher leverage). In adverse circumstances in 2014/2015 (when gold prices had fallen and regulations were unfavourable), Muthoot and Manappuram reported their lowest ROE of 14% and 9% respectively. These businesses have been so profitable that they are among the few lenders that haven’t raised any equity capital post their listing. The amounts of dividends paid out by these companies exceed the total equity capital raised by them since inception.

Q: But this looks like a very simple business. Why is it so profitable?

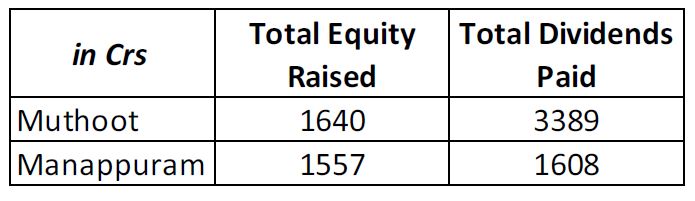

A: Yes, this indeed is a very simple business. Other lending categories require extensive underwriting capabilities to understand borrower cash flows, intent to repay, quality of collateral, etc. A GL transaction is fairly straightforward.

Because of the simple nature of the business, GL is one of the oldest consumer financing categories in India with a history of more than a century. Till recently, the industry was dominated by pawn-brokers/moneylenders who even now account for over 65% of the GL business1. The poor pledging their jewellery with a local moneylender had been a common trope in Indian cinema for many decades. It has only been over the last 2 decades that NBFCs and Banks have become prominent in this space.

Because of the simple nature of the business, GL is one of the oldest consumer financing categories in India with a history of more than a century. Till recently, the industry was dominated by pawn-brokers/moneylenders who even now account for over 65% of the GL business1. The poor pledging their jewellery with a local moneylender had been a common trope in Indian cinema for many decades. It has only been over the last 2 decades that NBFCs and Banks have become prominent in this space.

Despite the simplicity, the leading GL players enjoy an extremely high profitability. There are two main reasons for it.

1. Brand matters

Consumers care a lot about the brand of the entity they deposit their money with. However, when they borrow, they only care about the interest cost and the convenience. When a consumer takes a car loan, a home loan, a microfinance loan, or a business loan, he doesn’t care if it is from HDFC Bank or XYZ bank as long as it is cheap and convenient. GLs are an exception in this regard. In the case of a gold loan, the borrower is physically pledging his gold worth 100 rupees with the lending entity for a loan worth only 75 rupees. In addition, the ornaments carry sentimental value and adornment value (making charges are not included in the calculation of collateral value). He would therefore like to take the loan from someone who he can trust with his gold — someone who is known and has a long history and track record.

A borrower is unlikely to pledge his/her gold jewellery with an unknown player over a trusted player even if the former offers a lower interest rate. This gives pricing power to strong incumbent brands vs new players and creates an entry barrier.

The large GL specialists like Muthoot and Manappuram have decades of operating history and have cumulatively spent 1000s of crores on brand spends to create trust among their borrowers. These companies are synonymous with GLs and have high brand recall. Even between the two largest players, there is a stark difference between brand strength. Muthoot’s higher brand recall is reflected in its average loan per branch which is 1.9x of Manappuram. Muthoot has been responsible for creating and expanding the GL market in non-South markets with aggressive marketing spends (Non-South markets now account for 51% of Muthoot’s GL AUM). No other lending category requires such a high focus on brand building.

2. Operating Leverage/Economies of Scale

2. Operating Leverage/Economies of Scale

The GL business has a high operating leverage. The business has high fixed costs that result in significant economies of scale for larger players. The operating leverage is because of fixed costs at two levels – HO level and branch level. The more important operating leverage is at the branch level. Every branch has high fixed costs in the form of rent, manpower, assaying machines, security costs etc. Below a certain scale, a branch is unprofitable. Scale (AUM) in GLs requires brand strength. The long operating history and brand strength of Muthoot and Manappuram has allowed them to gain substantial scale and build a large branch network (Muthoot and Manappuram have 3500+ branches, larger than many frontline banks in the country). As these companies invest in their brand by advertising at the national level (IPL sponsorship etc.), their vast network of branches is able to derive direct benefit. Muthoot, which is the largest GL player, still enjoys a 150 bps advantage in Opex/AUM over Manappuram, the second largest player. The smaller players are unable to make these investments due to the lack of a large branch network. It is a chicken and egg situation for every new entrant as scale cannot come without brand strength and investments in brand cannot be profitably done at a subscale size.

Another benefit of scale is the cost of funding. As size and profitability increases, the credit rating of the company improves, resulting in a lower cost of funding. The incremental cost of borrowing for Muthoot and Manappuram is below 8.5% compared to the much higher cost of funding for smaller NBFCs.

Pricing power (ability to charge higher) + low Opex/AUM + low borrowing costs leads to high profitability for the likes of Muthoot and Manappuram. For a smaller player, higher Opex/AUM and higher borrowing costs impacts both their profitability and ability to compete effectively till they reach a certain scale.

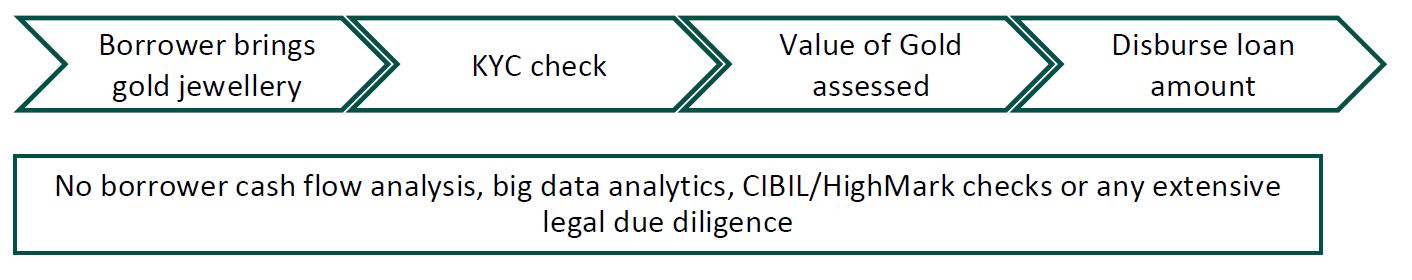

Q: Wait, banks already have fairly strong brands, large branch network and a much lower borrowing cost than Muthoot/Manappuram. How can GL NBFCs possibly compete with banks that offer GLs at less than 10%?

A: Banks lack focus. Most banks have a diversified loan product portfolio ranging from mortgages, corporate/SME/MSME loans, personal loans, auto loans, agri loans, credit cards etc. In addition to this, they provide tons of fee-based services such as insurance/MF sales, broking, forex, transactional banking, investment banking, etc. Bank organizations are structured to provide a wide and diverse set of services to their customer base. These generalized capabilities make them ill-suited for the GL business which requires a specialist approach.

The GL business while simple is operationally intensive. The average GL is small ticket in nature (~Rs 60k) and has a tenure of only ~4 months. Even building a small 1000 cr GL AUM requires an organizational infrastructure that can deal with lakhs of borrowers every month. In comparison, building a 1000 cr mortgage book requires dealing with less than 100 borrowers a month.

Specialist GL NBFCs require minimal KYC documentation, are open for longer hours, have fulltime gold valuers at each branch and can thus disburse GLs with a turnaround time (TAT) of less than 15 mins. Banks service levels do not come close to matching the high standards of the GL NBFCs. Most banks which offer GLs do not have fulltime gold valuers at all their branches. They often have fairly cumbersome documentation requirements (some even requiring GL borrowers to open a new bank account). This results in a TAT that stretches from few hours to few days which doesn’t work for the typical GL borrower.

A bank’s cost structure is significantly higher than a typical GL NBFC branch – much higher rents, higher employee cost, higher fixed asset investments etc. Therefore, banks focus on products that are higher ticket size and longer in tenure. The lifetime profitability of such a product is higher than the small ticket GLs. This is also the reason why most banks outsource microfinance loans to business correspondents.

Banks do offer GLs at cheaper rates compared to GL NBFCs. However, for the small ticket and shorter tenure borrower, the lower interest rates do not make a material difference. This explains why the average GL ticket size for banks is >2 lakhs and has a longer tenure. Banks are better suited for larger borrowers for whom the lower interest cost makes a material difference. This segment of borrowers is less profitable due to its price sensitivity and is not the main target market for GL NBFCs. In order for banks to capture a larger pie of the more profitable small ticket GL market, they would have to markedly improve their service levels which is a tall ask.

Q: But haven’t many of the banks grown their GL book by 60%+ in FY21? GL NBFCs are clearly losing market share to them.

A: Yes, Banks have seen a big jump in their GL book in FY21 and gained market share against GL NBFCs. Two key changes have led to this growth.

- Post the Covid-19 lockdowns in March 2020, banks became risk averse and substantially reduced loan disbursals. It was the prudent thing to do considering it was unclear how the lockdowns would impact the economy and the borrowers. In this period, GLs became the only loan product which was safe for them to push due to the security of a liquid collateral that had increased in value with rising gold prices. The meaningful shift in focus from other products to GLs led to higher loan disbursals in this segment.

- In August 2020, RBI raised the maximum loan-to-value (LTV) that banks could lend against gold jewellery from 75% to 90%. This was a major change which put banks at an advantage vs NBFCs which were allowed to lend only up to 75% LTV. Many banks capitalized on this change and aggressively marketed their higher LTV offerings. They were able to give much larger loans to not just their existing borrowers but also acquire new customers from GL NBFCs who were attracted by the larger loans being given for the same jewellery. This has led to the big jump in the GL book for banks in this financial year.

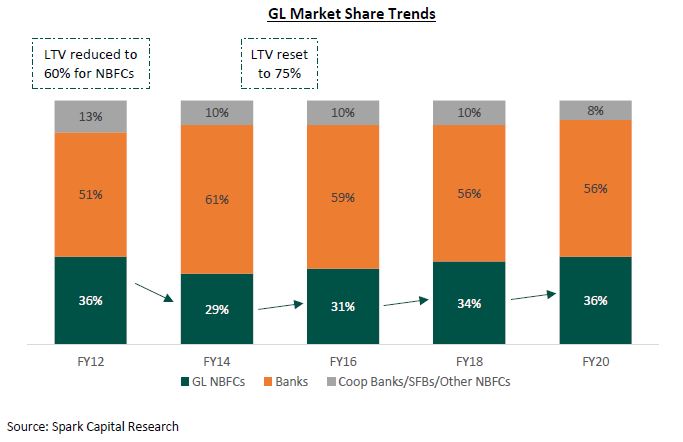

Our view is that both these factors that have led to market share gains for banks are temporary in nature. As the lockdown-led uncertainty reduces, banks will again shift their focus back from GLs to other products which are more lucrative for them. From April 2021, the GL LTV of banks will also reset lower to 75%. This will again level the playing field for GL NBFCs. It is likely that GL NBFCs will be able to recover some of the lost market share when this happens. Even in the 2012-2014 period, GL NBFCs had lost market share when the RBI reduced the LTV to 60% for NBFCs while keeping it at 75% for banks. When the LTV was reset back to 75% in 2014, GL NBFCs were able to again grow faster than banks.

Some part of the banks higher reported growth is also believed to stem from a change in classification of agri GL borrower to retail GL borrower. The 90% LTV was only applicable for retail GLs and not agri GLs. So, banks shifted many of their agri GL borrowers to retail GLs by giving larger loans. This shift does not impact GL NBFCs as they do not operate in the agri GL market which is driven by government interest subsidy and is not lucrative.

As things normalize in FY22, we should get a clear picture as to whether there has been any fundamental change in the competitive landscape in the GL market.

Q: It will be interesting to see if history repeats and GL NBFCs are able to recover their lost mojo in FY22. What about disruption from tech startups? Startups like Rupeek have raised tons of money and are aggressively growing their GL business. Aren’t they a threat?

A: Yes, they are probably the biggest competitive threat facing the GL NBFCs. VC-backed startups like Rupeek have achieved a respectable scale (company claims to have an AUM>1000 crores) and continue to grow rapidly. Their business model is to deliver quick GLs (in less than an hour) at the doorstep of the borrower. They have tied up with banks like Federal Bank, ICICI Bank and Karur Vysya Bank for lending using their balance sheet and for using their network of physical branches to store the gold jewellery. This enables them to have a branchless presence across the country. Players like Muthoot and Manappuram have taken notice of these innovative business models and have started their own doorstep service too.

As of now, these startups are highly loss-making and there are doubts whether doorstep GLs can ever be profitable due to the high cost involved. However, these startups have attracted the attention of large VCs who are willing to tolerate long periods of cash burn as long as growth is sustained. If these startups are able to scale up and figure out a profitable business model, it could pose a material risk to the traditional GL NBFCs.

Q: Isn’t this a cyclical business – growing only when gold prices rise?

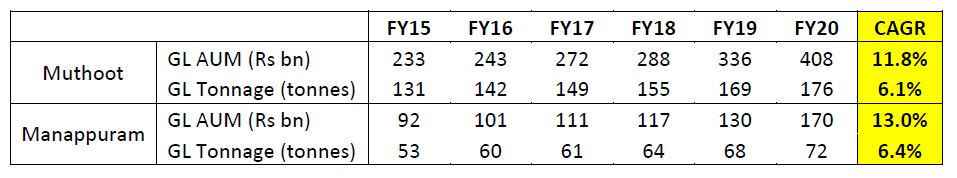

A: Yes, the GL business has a high dependence on gold prices. When gold prices rise, GL AUMs grow as the borrower can be given a larger loan for the same piece of jewellery. When prices fall, the reverse happens. The rise and fall of gold prices bring an element of cyclicality into GL growth. However, underneath the cyclicality of the gold prices there is also a structural growth story in the GL business. This can be seen in the gold tonnage growth of the leading GL NBFCs over the last 5 years.

Gold tonnage growth over the last 5 years has been healthy for both Muthoot and Manappuram. This suggests that while growth has benefited from rising gold prices, volumes continue to contribute to growth. Moreover, it is normal for tonnage growth to be weak if gold prices rise as borrowers need to pledge lesser gold to meet their credit needs. In periods of flat or declining gold prices, tonnage growth picks ups as borrowers pledge more gold. The inverse correlation between tonnage growth and gold price growth reduces the cyclicality in GL growth due to fluctuating gold prices.

Even now the unorganized sector (pawnbrokers/moneylenders) comprises 65% of the overall GL market. There is still a lot of room for the organized sector to gain market share from the unorganized. The GL market also continues to grow in penetration as the cultural stigma associated with pledging of gold is being reduced through advertisements and promotions by GL players. GLs are also increasingly being used by SMEs/MSMEs for their business credit needs. Our view is that barring a sharp fall in gold prices, the GL market should continue to grow at 10%+ driven by increasing penetration and market share gains from the unorganized sector.

Q: What will happen to credit costs if gold prices crash? Can GL NBFCs survive a major crash?

A: A fall in gold prices has a negative impact on asset quality of GLs. However, the impact is much lower than what most market participants assume.

- The average portfolio LTV of GL NBFCs is typically around ~70%. For some loans the LTV may increase to 80-85% including accrued interest. For a loss of principal to occur, there would have to be at least a 15-20% decline in gold prices. Otherwise, the loss is limited to the interest income. For the asset quality to be impacted across the portfolio, gold prices would have to fall >30%.

- A large number of borrowers do not default even when the value of the gold is below the principal outstanding. This is because there is sentimental value attached to the household gold jewellery. The LTV calculations also do not include the value of semi-precious stones and making charges which may be material in the eyes of the borrower. So, the practical LTV is often much lower than the LTV against which the loan has been disbursed. Some of the borrowers will also not default if the loan amount is not large to ensure that their credit score is not hurt.

- The average tenure of a GL is less than 4 months and some players like Manappuram give GLs with a 3-month tenure. If gold prices fall over a period of time, the GL portfolio gets repriced at lower gold rates without any meaningful impact on asset quality. This ensures that GL NBFCs can tolerate a fairly large gold price fall if it happens over a period of time as the overall portfolio LTV keeps reducing.

The above points explain why GL NBFCs have seen negligible credit costs in their GL portfolios despite fluctuating gold prices.

The biggest risk for GL asset quality would be if there is a sudden and sharp fall in gold prices (for eg. a single day price fall of >25%). While such an event has never happened before, there is always a first time. GL NBFCs will be badly wounded in such a scenario. However, they will still survive such an event because of the low LTVs, borrower propensity to not default even when collateral value is below principal value, on-book excess provisions, high core profitability and low BS leverage.

As per 2Point2 Capital estimates, a GL player like Muthoot will not have more than 3% credit costs even if gold prices fall 25% in a day. This means it will not have to report a quarterly loss. If gold prices fall up to 50% in a day, Muthoot will still be able to meet the capital adequacy requirements. A steep gold price fall over a longer period of time (6 months+) is quite manageable and does not pose any survival risk for the GL NBFCs. The GL NBFCs have the ability to absorb a lot of pain and are not as susceptible to gold price fluctuations as feared.

Q: What would have to happen for you to change your positive view on GL NBFCs?

A: While GL NBFCs have so far been great businesses, this could change. In the business world, there is no dearth of once great businesses becoming mediocre with the passage of time. This could happen both due to internal and external reasons.

The two key risks that we need to keep a watch on are:

- Regulations: There is always a risk that RBI could bring adverse regulations that impact the profitability and/or growth of gold finance companies. RBI has previously made regulatory changes (different LTV norms) that have tilted the playing field in favour of banks. There is also a fear that RBI could cap interest rates for GL NBFCs which charge 25%+ in some cases. Any such measure hurts the viability of the GL business model for NBFCs.

While RBI has put NBFCs at a temporary disadvantage in the past, it has eventually reverted to a uniform regulation between banks and NBFCs. Over the last few years, RBI has tried to bring product level regulations rather than entity level regulations. It is likely that RBI does not want to create a regulatory arbitrage in the same asset class between a bank and an NBFC over the long term. Recent draft regulations seeking to harmonize microfinance regulations across NBFC-MFIs/SFBs/Banks is reflective of this trend. - Competition: Any industry with a large profit pool is likely to see the entry of new players trying to grab a piece of the pie. The GL market is no different. A large number of players are attracted by the supernormal profits being made by the leading GL NBFCs and try to compete with them. So far, the GL NBFCs have been to keep the competition at bay and maintain their market share.

The last year has seen the emergence of both banks and startups trying to disrupt the stronghold of traditional GL NBFCs. Both of these players have some positives and they can pose a serious long-term threat to GL NBFCs. We will have to keep track of how these competitive dynamics play out and whether they are able to meaningfully hurt GL NBFCs.

Disclaimer: All information provided is for information only and should not be considered as investment advice or a recommendation to purchase or sell any specific security. 2Point2 Capital may or may not currently have a position in any of the securities mentioned above.

seo Monthly package

%%

Look into my blog :: seo Monthly package