Company A is a listed ‘Consumer-Tech’ business in a highly competitive industry. The IPO of this company was significantly oversubscribed by retail and institutional investors. Excluding the Promoters, this ‘tech’ company has NO Engineers in its top management. The median salary of the employees in the company was less than 2 lakhs in FY21 (2.5 lakhs in FY20). The highest salary that any employee/senior management draws is less than INR 25 lacs per annum (ex of Promoters).

Find anything fishy in the above data?

These are absurdly low salaries for an internet business claiming to be among the top 3 in its industry. How does a consumer-tech company compete in the marketplace by paying wages lower than what a driver or a delivery person makes in most metros? Are the employees not aware of how much in-demand their skills are in the new digital world?

A familiar rejoinder to such concerns has been –

Paisa hi sab kuch nahi hota, Job satisfaction bhi koi cheez hai

Degree hi sab kuch nahi hoti, Talent bhi koi cheez hai!

We received a similar argument from the Promoters of a beverage company when we wrote about their low salary levels (among other things) a few years back. The median salary of the top management of the company was 4.6 lakhs per annum, an abysmally low number for people with 10-20 years of work experience. The educational backgrounds/prior work experience of the employees too was ordinary. The company has destroyed 100% of its equity value since then and the Promoters were arrested for GST invoice fraud.

We are in the midst of a bull market and IPO frenzy is at its peak. Anything that can market itself as ‘tech-this’ or ‘specialty-that’ is being touted as the next multi-bagger by the investing community. It is no surprise that in such periods of euphoria, a lot of junk masquerading as gold will get sold to unsuspecting investors. We are seeing a number of companies with shallow management teams and limited human capital fetching billion dollar+ valuations. Focusing on the absence/presence of human capital is a good way to eliminate dodgy companies and increase the odds of investing in scalable franchises.

Why does human capital matter? Most companies in India are Promoter driven – both run and managed by the Promoters. Along the way, as they become big, they professionalize their companies by hiring external talent. It is imperative beyond a certain size. There is simply no way that the promoter family alone can cater to all demands of running a complex business at a much larger size. As expected, despite high promoter holdings, most of the larger companies in India are professionally managed.

It is important to remember that all the moats that we love as investors were built by people with their vision and hard-work. Value is not created by itself but is an outcome of people’s efforts. When we encounter companies that have grown big or are growing rapidly without any significant investments in human capital, we wonder if the business and its growth is real. If the business/growth is indeed real, then the sustainability of this growth is questionable. A Promoter might have single handedly steered a company to a certain size, but the absence of human capital will make it difficult to sustain the past growth.

Measuring human capital is therefore an important part of any investment diligence process. While we investors spend a lot of time trying to understand the financials of a company and the story behind them, we spend little time measuring human capital. While financial numbers are static in nature and do not indicate the ability of the company to sustain those numbers in future, human capital throws light on the sustainability of the business. It is also easy to fudge numbers/financials but it is not so easy to fudge human capital.

We describe below some forensic techniques that we use at 2Point2 Capital to both qualitatively and quantitatively evaluate human capital at companies.

Measuring Human Capital

We measure Human Capital in any company using three yardsticks – Quantity of Talent, Quality of Talent and the Company’s culture.

1) Quantity: A growing business needs a growing number of employees. An IT company, or a FMCG company, or a manufacturing company, or a financial services company will all see growth in number of employees before they see growth in business. Even if a business is not growing, the employee base should be commensurate to the size of the business.

How do we measure: One primary source of employee count for any company is the EPFO website which captures the monthly number of employees for whom the company is depositing provident funds. This is primary data and difficult to fudge.

A business that expects to expand will hire in advance. Aggressive hiring is often a sign of confidence. The above table depicts employee count for a listed company. The company’s EPFO-linked employee count has expanded by 20% from 9,061 to 10,758 between January and July 2021. This ties in with the growth guidance given by the company. LinkedIn is another source that gives a rough indication of the number of employees that work for the company and the number of new openings etc. When there is a large disconnect between business growth and employee growth, we must be wary. The growth maybe fake, or potentially short lived/unsustainable.

The growth in number of employees however may not be linear because of economies of scale in the business. The relationship may not especially hold true for platform businesses that have network effects. For instance, Whatsapp had just 50 employees when it was already one of the largest social networks in the world. Most Indian companies, however, are linear businesses where we expect to see some correlation between business growth and employee growth.

2) Quality: Growing businesses require good talent to sustain the growth and protect the moat. Typically, good talent will have one or more of the following characteristics – it will be drawing a good salary, will have prior experience in good companies and may even have a good educational background. While there may be people who do not meet one or more of these criteria and may still be assets to their organization, companies that are doing well and are hiring at scale will have a large number of employees that meet these criteria.

How do we measure: LinkedIn is a great source to check employee backgrounds, especially for mid and small sized companies. For instance, when we made an investment in Garware Technical Fibres in 20161, we went through the profiles of all senior and mid-level employees on LinkedIn. We were impressed to see that for a company with less than Rs 1300 crores in market cap, it had employees with prior work experience in leading domestic and multinational companies. The company was already hiring from Tier 1 and 2 colleges. Not only were such employees joining the company, they were also sticking around for several years. Attrition was limited in senior management.

There are several sources such as the RHP2 (filed just before the IPO) or the Annual Reports that one can tap to get a flavor of the salaries of the senior employees. The RHP has to disclose the salaries of all the KMPs. Similarly, the Annual report has to disclose salaries of positions such as the CFO, CS and other senior employees. Inexperienced CFO and CS profiles and abysmally low salaries often indicate poor focus on financial controls and compliance. Many recent IPOs seem to have filed the CFO role with relatively junior personnel at the last moment just to meet the SEBI listing requirements.

The Annual Report also has to disclose the median salaries of the employees. Comparing the median salary between two companies in the same industry can often give you a flavor of the pedigree of the employees. The average salary of a recently listed specialty chemical company is 3.3 lpa which is 20-70% lower than other similar companies in this space. This is especially odd given that the company claims to have superior R&D capabilities, higher EBITDA margins, supernormal ROEs and is seeing strong growth in its business. Are these numbers sustainable despite such limited human capital investments? In a competitive world, substantially lower wage levels vs peers is reflective of a weaker talent base.

3) Culture: Great companies are built on the base of a good corporate culture. But how do we measure culture?

How do we measure: Attrition is a good measure of a company’s culture. A high attrition is indicative of dissatisfied employees. We can get a rough sense of attrition at the senior management level from LinkedIn. Speaking to ex-employees can also give an insight into the company’s culture. We have often reached out to ex-employees of a potential investee company on LinkedIn (through mutual connections) to take reviews on the culture of a company. While current employees can give you a good picture too, but they have a conflict of interest. Ex-employees are likely to be more balanced in their views. Reading Glassdoor ratings and reviews on the company can also give a good insight of what current and ex-employees think about their company.

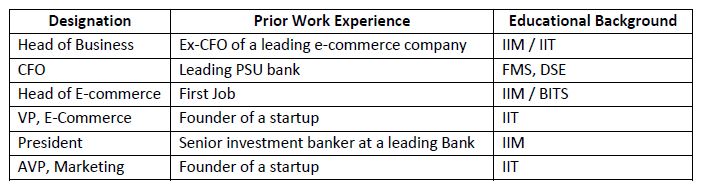

By no means are we saying that human capital alone can dictate the future success of a company. It is a necessary but not sufficient condition for making an investment decision. But, if any company scores poorly on these human capital parameters (like some of the companies mentioned above), we are better off avoiding them. Having said that, a good score on human capital parameters alone is not sufficient for us to consider an investment in a company. There are several other factors that are more or equally important. For instance, see below the impressive profiles of few ex-senior management employees of a Jewelry3 company that has destroyed more than 95% of investors’ wealth:

Human Capital is a key ingredient (though not the only one) for business success and therefore market capitalization. In the current market environment, we see large market-caps being ascribed to companies lacking any meaningful human capital. For a long-term investor, absence of a respectable human capital base should be a good enough reason to not invest in a company.

_____________________________________________________________

1We currently don’t own the stock

2Red Herring Prospectus

3While the company had high profile personnel in the senior management, its median employee remuneration was still 66% lower than that of India’s largest jewelry company.