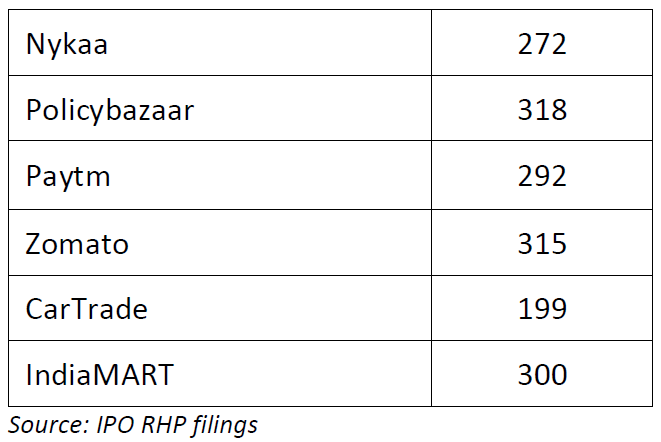

The disproportionate value creation by the FAANG stocks over the last decade has made ‘Platform’ a buzzword among investors and start-ups. Every business wants to call itself a Platform to attract investors, and dissuade competitors. The most unlikely businesses have called themselves platforms – WeWork (Co-working), Beyond Meat (Synthetic Meat), Casper (Mattress e-commerce) and Peloton (Exercise bikes). In India too, Platform is a highly coveted tag. Almost all tech companies that got listed in the last 3 years call themselves Platforms. The below table outlines the number of times the word ‘Platform’ was used in the Red Herring Prospectus (RHP) of some of the recent tech IPOs:

We have previously written about the Platform business model more than three years back in our Q4FY19 investor letter. At that time there were only a few Platforms listed in the Indian markets. In that letter, we had discussed the investing implications of the rise of platforms (with particular focus on the disruptive threat to incumbent brick and mortar/non-platform businesses). Since then, several so-called Platform businesses have listed in India.

In our Q4FY19 letter, we had said –

To be fair, all the companies that we mentioned in the Table above fit the definition of a Platform (they connect and facilitate exchange of value between two user groups, and they all have network effects). But are all platform companies invincible? Do all of them have ‘winner-take-all’ characteristics? Should investors avoid all businesses that compete with these companies? The recently published book ‘The Platform Delusion’ by Jonathan Knee provides good answers to many of these questions. We discuss the key takeaways below..

Platform-dom is not a Panacea

The invincibility of ‘Platforms’ as a business model is more a myth than a reality. The author debunks the four pillars of the ‘Platform Delusion’:

- Platforms are a revolutionary new business model: While digital platform businesses have gained prominence over the last two decades, Platforms have been around forever. Even before the dawn of the internet, there were large ubiquitous analog platforms. Credit card companies such as Visa and Mastercard provided a platform for merchants and consumers to transact. Malls provided a platform for buyers and sellers to interact. Theatres provided a platform for movie-goers to experience movies produced by studios.

- Digital platforms are structurally superior to analog platforms: The author argues that the long-term financial performance of digital platforms have been inferior to their analog peers. This suggests that competitive advantages in the digital realm are weaker compared to those in the physical world.

The author compares Shopping Malls and their digital counterparts E-commerce companies (both are two sided platforms connecting buyers and sellers) to demonstrate this point. Malls have two structural advantages – their vendors are committed to long term leases and their shoppers need to travel many miles to find the next alternative. This results in customer captivity and enables them to generate superior returns for their investors. An e-commerce platform’s relationship with its buyers and sellers exhibits none of this durability. A buyer is free to shop anywhere and a seller will optimize by selling on all platforms. Estimates of e-commerce’s failure rates are as high as 97%. Some advantages of digital platforms (network effects, zero marginal cost) are often completely negated by other disadvantages (low entry barriers, low switching costs). - All platforms exhibit powerful network effects: Most platform businesses benefit from network effects. It is expected that these network effects create a virtuous cycle of growth with each new user increasing the attractiveness of the business. However, to create strong defensibility, network effects must be accompanied by high switching costs or else the network effects are ephemeral. Even with the presence of network effects, the success of an enterprise depends on multiple other factors.

Zoom is a communication platform that enables users to connect by simply clicking on a browser link. During the pandemic, the stock zoomed ~8x because of the sudden demand for such a service. However, soon a number of competing products (MS Teams, Google Meet) were able to gain market share. Zoom’s initial success which was driven by its network effects was easily overcome due to the low switching costs of the service. The stock has crashed more than 80% from its peak since then. - Network effects lead inexorably to winner-take-all markets: Even in well-established domains such as e-commerce marketplaces, there are dozens of players, old and new, that are targeting various spaces. The Indian e-commerce market remains intensely competitive. While Flipkart and Amazon lead in consumer electronics, Myntra leads in Fashion, and BigBasket / JioMart lead in Grocery. New players such as Meesho have significant presence in niche areas such as Tier 2+ markets. Players like Nykaa and PharmEasy are market leaders in specific categories such as beauty and medicines.

In short, just because a business is a platform business, doesn’t say anything about how good or bad it is. Network effects alone are neither sufficient nor necessary to build durable competitive moats. The business must be accompanied by age old durable competitive advantages to survive and make money.

Platforms too require Sustainable Competitive Advantages

In his seminal piece ‘Competition Demystified’, Bruce Greenwald said that there are really only three sources of competitive advantages (or ‘moats’) for a company:

- Economies of scale: If costs per unit decline as volume increases (because fixed costs make up a large share of total costs) then even with the same basic technology, an incumbent firm operating at large scale will enjoy lower costs than its competitors.

- Supply: These are strictly cost advantages that allow a company to produce and deliver its products or services more cheaply than its competitors – either due to privileged access to inputs or proprietary technology that is protected by patents or by experience/know-how or some combination of these.

- Demand: Some companies have access to market demand that their competitors cannot match. These demand advantages arise because of brand, customer captivity that is based on habit, or on the costs of switching, or on the difficulties and expenses of searching for a substitute provider.

How relevant are these age-old moats in the age of digital platforms? The answer is “very relevant”. But there is an added source of competitive advantage that Greenwald did not discuss in detail but is uniquely facilitated by the internet. This is the ubiquitous Network effects or the Flywheel effect that everyone talks about. We discuss below these sources of competitive advantages in context of digital businesses / platforms.

Offline businesses benefit from supply side scale advantages as the fixed costs are spread over a larger base reducing the per unit cost of operations. The internet, however, has reduced the relevance of this supply side scale advantage because of significant reduction in the fixed cost of operations, particularly marketing and distribution. Jonathan Knee says, “The internet facilitates the establishment of an entirely different breed of scale advantage that does not owe its existence to high fixed costs”. This is what we call network effects or the flywheel effect. “Rather than representing a supply advantage, network effects yield a benefit on the demand side of the equation: the bigger you are, the easier it is to attract new customers and incremental revenue”, says Jonathan Knee.

In essence, the internet makes it harder to secure supply side (fixed cost) scale advantage but easier to develop demand side scale advantage through “network effects”. However, it has not totally eliminated the supply side scale advantage.

Scale advantages by themselves, whether manifested through demand or supply-side benefits, are fragile without reinforcing entry barriers. If the only advantage is supply-side scale (fixed cost advantages), then the business is vulnerable to anyone with deep pockets willing to share the spoils. Some degree of customer captivity can however prevent competitors from capturing meaningful market share. Demand side scale (network effects) advantages are similarly fragile. Beyond simple habit, the most typical forms of customer captivity are switching and searching costs. Internet reduces the frictional cost of switching/searching thereby reducing barriers to entry for new players..

Evaluating two consumer-tech companies

We evaluate the strength of Zomato’s and Nykaa’s business using the framework we discussed above. While Zomato and Nykaa have a host of competitive advantages, the nature of these advantages is very different.

Zomato is one of the two platforms that have a combined 90%+ market share of the online food delivery market in India. It is a two-sided platform that connects restaurants with users. Zomato’s main source of competitive advantage is the network effects inherent in its business model. Every additional restaurant or user on its platform increase the value of the platform. Restaurants want to be listed where the maximum users are and users want to use the platform that has the maximum number of restaurants. Zomato also has some traditional supply side economies of scale. For a pan India food delivery platform, a physical presence of delivery partners is required in all locations. This requires significant fixed cost investments for any new player to enter this market. However, Zomato has limited customer captivity because of limited search/switching cost. Customers mainly care about the lowest price and the fastest delivery. A user may easily shift to a Swiggy if it has better offers than Zomato.

Nykaa, on the other hand, has more traditional sources of competitive advantages such as supply side economies of scale, and customer captivity. In fact, Nykaa does not even fit the definition of a platform because it stocks and retails all the products itself (in its beauty business) and is not a marketplace like other e-commerce businesses. This has been a source of customer captivity for Nykaa as it has built a name for itself in authenticity and quality control because of the control it exerts on its inventory. Nykaa also benefits from supply side economies of scale. Nykaa has invested in creating a network of 100+ offline stores to create an omnichannel presence. It has created physical warehouses for stocking inventory and quickly delivering to its users. It incurs significant cost on advertising on national television or on hiring a celebrity brand ambassador. It also derives advantage from better gross margins due to a much larger scale.

While Nykaa does not have strong network effects (new users or new cosmetic brands do not really increase the value proposition of the platform) but that doesn’t take away from the fact that Nykaa is a superior business than Zomato (at least as of now). Its core business is highly profitable and it is at least 4x larger than its next competitor (2Point2 Estimates). This is despite the fact that Zomato has all characteristics of a Platform business.

Summarising, platforms are successful not because they are platforms but because they have the same sources of competitive advantages that traditional businesses have enjoyed for decades. In fact, it is more difficult for digital platforms to sustain some of these competitive advantages as discussed above. Although the key categories of competitive advantage have not changed, digital models undermine the ability to sustain certain entry barriers (such as customer captivity) but potentially facilitate network effects and other supply side advantages from some combination of data, technology and learning and sometimes from significant fixed costs as well..

.

Disclaimer: All information provided is for information only and should not be considered as investment advice or a recommendation to purchase or sell any specific security. 2Point2 Capital may or may not have a position in any of the securities mentioned above.

Nimmala Vinith Reddy

I really like your research papers and all I want to say is make it as a Newsletter like daily Newsletter or weekly because your way of explaining topics is good