The equity markets in India have begun FY24 on a promising note. Following a flattish FY23, the Nifty 50 index has surged by 14.0% in H1 FY24. Returns in the mid-cap and small-cap space have been notably higher. Stock returns in H1 FY24 have exhibited a negative correlation with market capitalization – the smaller the market cap, the higher the stock price appreciation. IPOs have once again gained popularity, experiencing massive oversubscription and substantial listing gains. SME IPOs are in a completely different orbit.

There are two key factors leading to this euphoria in stock prices of smaller companies.

One, the Indian economy is on a strong footing – economic growth is robust, inflation/interest rates are relatively ok, global geo-politics favours us, bank NPA problems are history, capex recovery is visible, etc. Smaller companies often reap greater benefits from broad-based economic growth. Many of the smaller companies operate in cyclical and government-dependent industries which have done poorly over the last decade. A strong economic cycle will disproportionately benefit these companies. As revenue and margins both recover from their lows, the stock price appreciation can be large.

The second factor driving stock prices of smaller companies is capital flows. The last few months have seen significant inflows into mid-cap/small-cap focussed mutual funds, PMSes, and AIFs. Such large flows can drive stock prices far above fundamentally justified levels due to low liquidity. A feedback loop is in play here as well. Many investors buy small-cap stocks anticipating that institutional funds will buy these stocks at higher level, due to continuous inflows. This creates a self-fulfilling prophecy where stocks go up because of the expectation that they will go up.

Clearly, investors are quite optimistic right now. And that’s a good thing. Optimism is essential to be a successful equity investor. This brings us to the Stockdale Paradox. This paradox was first discussed by Jim Collins in his book, Good to Great.

Excerpts from Jim Collins’ Good to Great1

Not all optimists are the same. Stockdale survived the PoW camp because, while he was always optimistic about eventually getting out, he knew the short-term could be brutal.

The Stockdale Paradox provides two relevant lessons for investors:

- Unwavering faith: Stockdale emphasized the importance of maintaining unwavering faith in your ultimate success. This means believing that, over the long term, you will achieve your goals as an investor, even in the face of adversity and challenges.

- Confronting reality: Stockdale also emphasized the necessity of confronting the harsh realities of your current situation. Investors must recognize and accept the risks and uncertainties inherent in financial markets. Ignoring or downplaying these realities can lead to sub-optimal outcomes.

Many of the investors excited about the prospects of investing in small and mid-caps currently are akin to the PoWs hoping to get out by Christmas. Their optimism isn’t driven by their unwavering faith in the long-term Indian economic growth story. It is driven more by FOMO and the hope of making a quick buck. Lot of their optimism just seems to stem from the halo of the strong returns of the last few months. We wonder if the Indian economic situation has materially changed in the last 6 months for this newfound optimism. Even in March 2023, the Indian economy was performing quite well, but this optimism was absent.

These investors are probably also not aware of the harsh realities of the small and midcap segment. This space often experiences swift 30%+ drawdowns at the index levels and more at the individual stock level. Investors who have woken up to the opportunities in this space may not have the stomach to tolerate this level of volatility. Capital flows in this space can be highly cyclical and can bring down stock prices faster than they rise. Bullish periods like these also witness the emergence of many dodgy companies seeking to trap gullible investors. These can be massive wealth destroyers when the party ends. The small and midcap index itself can have elongated periods of zero returns, as observed in the 2017 to 2021 period.

Those hoping for an early Christmas by investing in the equity markets are most likely to lose faith if the market returns disappoint in the short term. There will be several explanations then to justify selling their stocks/mutual funds – interest rates, economy, geo-politics, valuations, capital flows, elections, etc. The fate of these investors would be analogous to those PoWs who died of a broken heart because they were only short-term optimists.

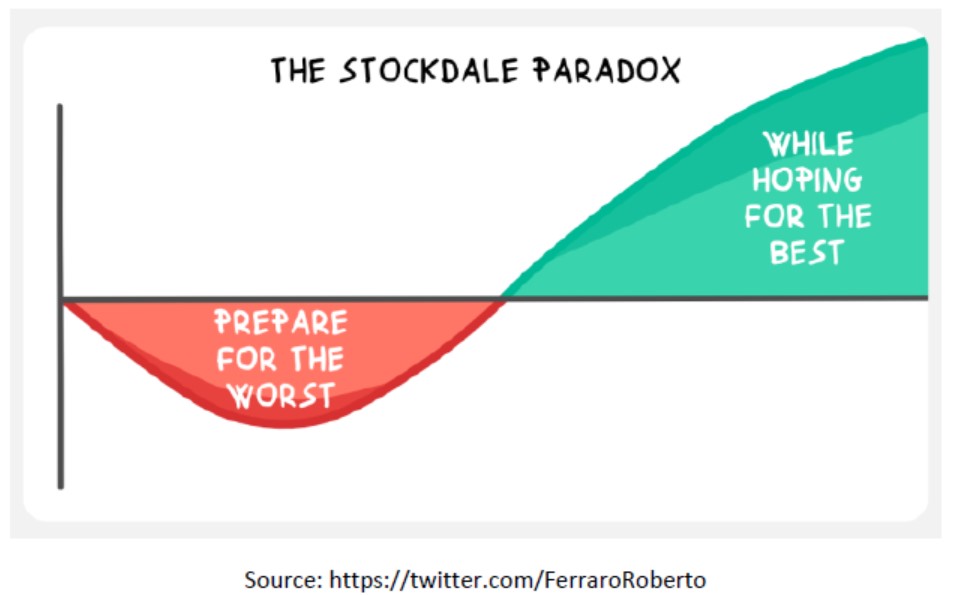

To survive and succeed like Jim Stockdale, we need to hope for the best but also be prepared for the worst. That would necessitate keeping the faith even if economic growth slows, some macro indicators weaken or capital flows turn negative. It is easy to be an optimist when the portfolio is hitting new highs, but we must retain our optimism even when stock prices are falling.

Investors often get caught up in short-term market fluctuations and noise. The Stockdale Paradox underscores the importance of maintaining faith in the long-term prospects of your investments. This perspective can help prevent knee-jerk reactions to market volatility. By confronting the brutal facts of the market, investors can avoid the trap of overconfidence and make more measured choices.

These choices include investing with a margin of safety, not succumbing to FOMO, and avoiding bad businesses that may be benefitting from short-term tailwinds.

Most successful investors exhibit the traits demonstrated by Jim Stockdale. For those in India, the faith in the long-term structural growth in the Indian economy acts as a guiding north star. They stay committed to their strategies and tolerate short-term fluctuations, just as Stockdale endured years of hardship. In the world of investing, where uncertainty is the only certainty, the Stockdale Paradox is a valuable parable to remember.

______________________________________________________________________________________________________

1Good to Great, Jim Collins, https://www.jimcollins.com/concepts/Stockdale-Concept.html