2018 has been a tough year for the broader markets. While the Nifty 50 is up, both the small and midcap indexes have taken a beating. Even among the small and midcap stocks, there are clearly diverging trends. Good businesses with strong moats have fallen far less than poor quality stocks which lack any significant moat. Even among poor quality stocks, there have been diverging trends. Poor quality stocks with governance issues have crashed 50-90% from their peaks.

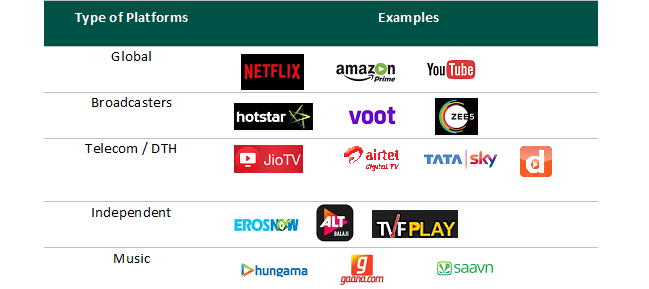

OTT Disruption In The Indian Media Sector

In January 2018, Netflix announced that it had crossed 54 mn subscribers in the US (i.e. 1 in every 2 US households). Netflix achieved this within 10 years of the launch of its over-the-top video streaming services (OTT[1]).

The last couple of years has seen a similarrapid rise in OTT platformsin India that did not exist few years back –

Investing in PSU Stocks

One of the major events of the last quarter was the announcement of a massive bank recapitalization plan by the central government. Over the last few years, PSU banks have been saddled with extremely high levels of bad debts which has eroded their capital position, limited their ability to compete with private banks and impacted overall credit growth in India.To ensure that the asset quality problems at PSU banks do not impact the economic growth, the government has proposed a 2-lakh crore PSU bank recapitalization plan.

How we generated “Alpha”

This section will address queries that our readers had on how we could outperform in a rising market despite 1) being conservative/risk-averse in our investment strategy and; 2) holding an average of 25%+ cash in the portfolio.

- Being greedy when everyone was fearful

During large parts of last year, we preferred to remain in cash rather than buy stocks at exorbitant valuations. There were long periods when we did not buy or sell a single stock. We used this time to research and build a pipeline of stocks we would buy if prices fell to attractive levels. This discipline of being patient and staying true to our value investing philosophy helped us create a large alpha.

Luck vs Skill

We are close to completing our first year of investing at 2Point2 and this is a good time to take stock of our performance so far. Since inception, we have generated 34.74% in returns compared to 11.64% of the Nifty 50 and 24.74% of Nifty Midcap 100 index. The overall performance has been quite good on both absolute and relative basis. This calls for a celebration. But, maybe not.

Consider the game of cricket. If you aren’t a good player, it is certain that you would struggle to even make it to the gully cricket team let alone dream of being part of the Ranji or national team. Thus, cricket is largely a game of skill. On the other hand, investing (over the short term) is an activity which has a high component of luck. Over the long term, the role of luck diminishes substantially in investing. However, sometimes luck can play a role even in a reasonably long investing period.

Stock drives business Or Business drives stock?

As stock markets reach dizzying heights in the absence of any fundamental change in business outlook, we increasingly see promoters employ various creative means to support or help prop up their company’s share price. While there is no harm in wanting to see the company stock reach new highs and create shareholder wealth, what is worrying is that promoters seem to be more focused on the stock’s performance rather than the business performance. Probably they miss the fundamental point that stock performance is an outcome of business performance and not vice versa. As long-term investors, we look at promoters’ undue focus on stock price as a warning signal that something is amiss. We discuss some such signals below.

Continue reading Stock drives business Or Business drives stock?

The Value of Cash

One of the most frequent questions that potential and existing investors ask us is about our high cash position in the portfolio. Currently, the cash allocation is ~19% of the portfolio value. This is clearly a high level. Most other funds do not have even 5% of their assets in cash.

Our high cash holding is not intentional due to our desire or belief in ability to time the markets. The cash holding is entirely an outcome of our investment process and capital allocation process – (1) finding an investment idea that meets our return objectives and (2) deciding the stock idea’s allocation in the portfolio. (1) and (2) are not disconnected. Very attractive ideas will invariably have a higher portfolio allocation.