“In investing, there are three ways to achieve a desirable “unfair” competitive advantage: the physically difficult, the intellectually difficult, and the emotionally difficult. The physically difficult way to beat the market is the most popular, or at least the most widely used. Believers in this game plan get up earlier in the morning, stay up later at night, and work on weekends. They read more reports, make and take more phone calls, go to more meetings, and send and receive more emails, voice messages, and text messages. They strive to do more and work faster in the hope that they can get ahead of the competition.

Avoiding Landmines: Focus On Free Cash Flows

“Show me the money!” – Jerry Maguire

With rising interest rates and tightening liquidity, the environment is becoming tougher for many dodgy businesses. These are companies that use all sorts of accounting shenanigans to report accounting profits even though the business truly does not make any money. Such frauds thrive in bull markets when investors focus primarily on accounting profits, and value businesses using earnings-based metrics like P/E or EV/EBITDA. The more the company is able to inflate its profits, the higher it gets valued. It is difficult for investors to ignore companies that are consistently reporting high ROEs and strong earnings growth.

Continue reading Avoiding Landmines: Focus On Free Cash FlowsIndian Exchanges – Rise Of Options Turnover

The trading volumes in India’s capital markets have seen significant growth in recent years. NSE’s Cash Equity volumes have tripled and Futures volumes have more than doubled over the last seven years.

Continue reading Indian Exchanges – Rise Of Options Turnover

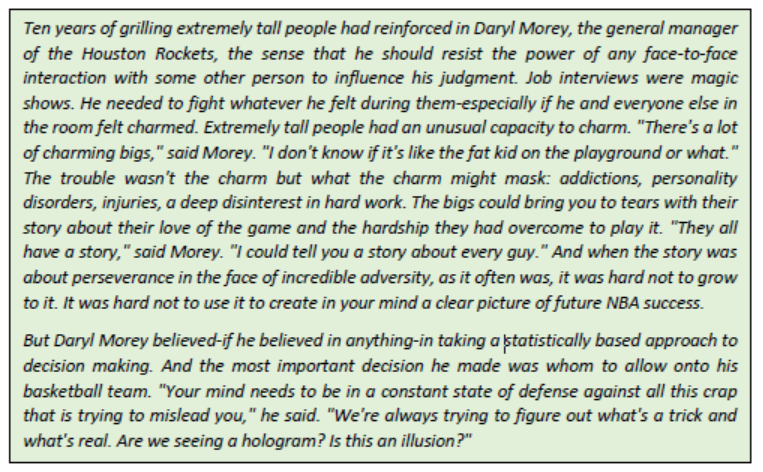

Are Management Meetings Useful?

The Platform Delusion

The disproportionate value creation by the FAANG stocks over the last decade has made ‘Platform’ a buzzword among investors and start-ups. Every business wants to call itself a Platform to attract investors, and dissuade competitors. The most unlikely businesses have called themselves platforms – WeWork (Co-working), Beyond Meat (Synthetic Meat), Casper (Mattress e-commerce) and Peloton (Exercise bikes). In India too, Platform is a highly coveted tag. Almost all tech companies that got listed in the last 3 years call themselves Platforms. The below table outlines the number of times the word ‘Platform’ was used in the Red Herring Prospectus (RHP) of some of the recent tech IPOs:

Microfinance 3.0

Last month, the RBI announced a new regulatory framework for microfinance (MFI) loans1 . In this note, we discuss how these regulatory changes impact the microfinance sector in India.

The new framework removes several restrictions that existed for NBFC-MFIs and creates a level-playing field for all types of MFI lenders (Banks, Small Finance Banks, NBFCs and NBFC-MFIs). These changes could lead to a structural increase in ROEs for NBFC-MFIs and open up new avenues for growth.

Luck Vs Skill – Once Again

In 2017, we wrote about Luck vs Skill. This is what we said –

Market Cap Without Human-Cap?

Company A is a listed ‘Consumer-Tech’ business in a highly competitive industry. The IPO of this company was significantly oversubscribed by retail and institutional investors. Excluding the Promoters, this ‘tech’ company has NO Engineers in its top management. The median salary of the employees in the company was less than 2 lakhs in FY21 (2.5 lakhs in FY20). The highest salary that any employee/senior management draws is less than INR 25 lacs per annum (ex of Promoters).

Find anything fishy in the above data?

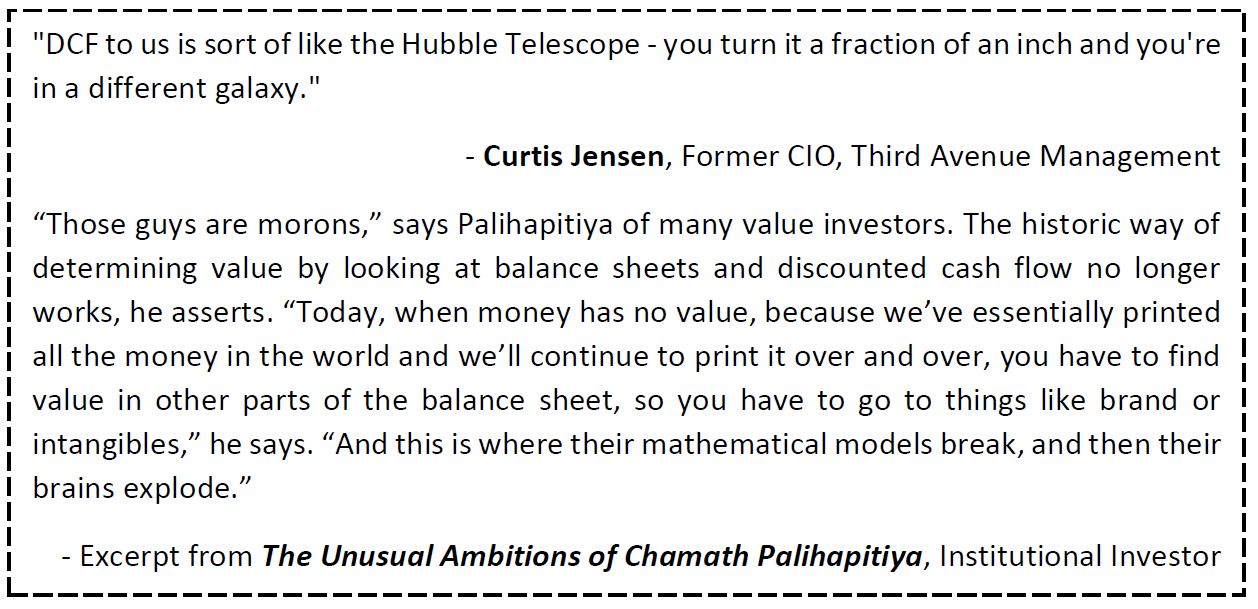

In Defence Of DCF

Q & A: The Gold Loan Business

Since we started the PMS in 2016, one of the largest sectoral allocations in the 2Point2 Long Term Value Fund has been in the Gold Loan space. Despite having sold a good chunk in some of the names (due to increasing concentration), it continues to be a fairly large allocation.

Naturally, we end up getting tons of questions related to these businesses. Below we share our answers to some of the most frequently asked questions. This should also help to articulate our investment thesis and why we continue to invest in this space.

Continue reading Q & A: The Gold Loan Business