The Platform Delusion

The disproportionate value creation by the FAANG stocks over the last decade has made ‘Platform’ a buzzword among investors and start-ups. Every business wants to call itself a Platform to attract investors, and dissuade competitors. The most unlikely businesses have called themselves platforms – WeWork (Co-working), Beyond Meat (Synthetic Meat), Casper (Mattress e-commerce) and Peloton (Exercise bikes). In India too, Platform is a highly coveted tag. Almost all tech companies that got listed in the last 3 years call themselves Platforms. The below table outlines the number of times the word ‘Platform’ was used in the Red Herring Prospectus (RHP) of some of the recent tech IPOs:

Microfinance 3.0

Last month, the RBI announced a new regulatory framework for microfinance (MFI) loans1 . In this note, we discuss how these regulatory changes impact the microfinance sector in India.

The new framework removes several restrictions that existed for NBFC-MFIs and creates a level-playing field for all types of MFI lenders (Banks, Small Finance Banks, NBFCs and NBFC-MFIs). These changes could lead to a structural increase in ROEs for NBFC-MFIs and open up new avenues for growth.

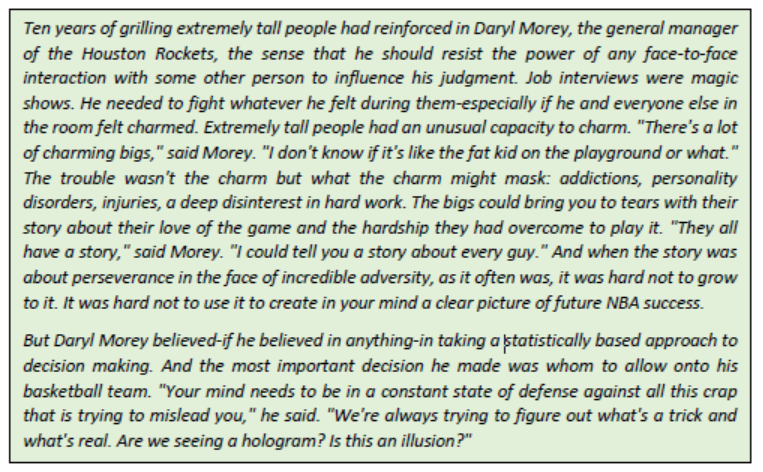

Luck Vs Skill – Once Again

In 2017, we wrote about Luck vs Skill. This is what we said –

Market Cap Without Human-Cap?

Company A is a listed ‘Consumer-Tech’ business in a highly competitive industry. The IPO of this company was significantly oversubscribed by retail and institutional investors. Excluding the Promoters, this ‘tech’ company has NO Engineers in its top management. The median salary of the employees in the company was less than 2 lakhs in FY21 (2.5 lakhs in FY20). The highest salary that any employee/senior management draws is less than INR 25 lacs per annum (ex of Promoters).

Find anything fishy in the above data?

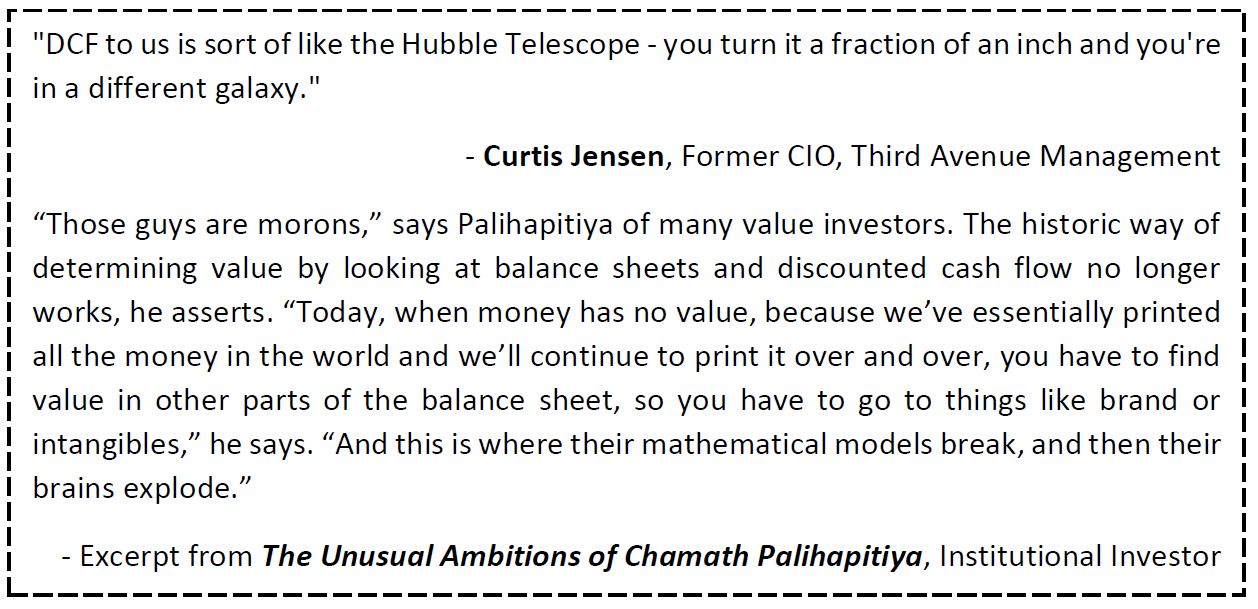

In Defence Of DCF

Q & A: The Gold Loan Business

Since we started the PMS in 2016, one of the largest sectoral allocations in the 2Point2 Long Term Value Fund has been in the Gold Loan space. Despite having sold a good chunk in some of the names (due to increasing concentration), it continues to be a fairly large allocation.

Naturally, we end up getting tons of questions related to these businesses. Below we share our answers to some of the most frequently asked questions. This should also help to articulate our investment thesis and why we continue to invest in this space.

Continue reading Q & A: The Gold Loan Business

Portfolio Management Services (PMS) VS Mutual Funds (MF)?

The equity markets in India (and globally) have had an extraordinary rally in FY21 with Nifty 50 returns of 64%. Mid and Smallcap stocks have done even better with Nifty Midcap 100 return of 79% and Nifty Smallcap 100 return of 98%. Continue reading Portfolio Management Services (PMS) VS Mutual Funds (MF)?

Our Worst Investments (So Far)

2Point2 Long Term Value Fund completed 4 years this quarter. The fund performance in this period has been reasonably good considering the tough market conditions (particularly for small and midcap stocks). While we have made many successful investments, the overall portfolio performance was dragged down by some laggards. Since inception, we have made 31 investments (25 core investments and 6 special situation positions) out of which 5 investments had losses of more than 15%. We discuss below these 5 investments – the investment thesis, what went wrong and learnings if any.

Investing In Holding Companies

India has a large number of listed Holding Companies (HoldCos) that hold shares of other listed and unlisted companies. A large part of the value of these HoldCos stems from their stakes in other businesses. Globally, HoldCos trade at a discount to the underlying Net Asset Value (NAV) of their holdings. These discounts tend to range between 5-20%. HoldCos in India are unique because the HoldCo discount is sometimes exceptionally high, ranging from 50-80%.